Sister Jeanie and Sister Elaine Hagedorn, who co-authored this post, are Catholic sisters with the Congregation of the Humility of Mary. They live in Des Moines and are longtime advocates for Catholic social justice with groups like NETWORK.

No matter where we come from or what we look like, Iowans believe that working families deserve a fair shot. All work has value, and all working people have rights, from farmworkers in vibrant rural towns to factory workers in our bustling cities. But for too long, a greedy few corporations and CEOs have rigged the game in Iowa and across the world, taking from working people to make sure that a powerful few can get rich off the profit that working Iowans, particularly Black and Brown working Iowans, produce.

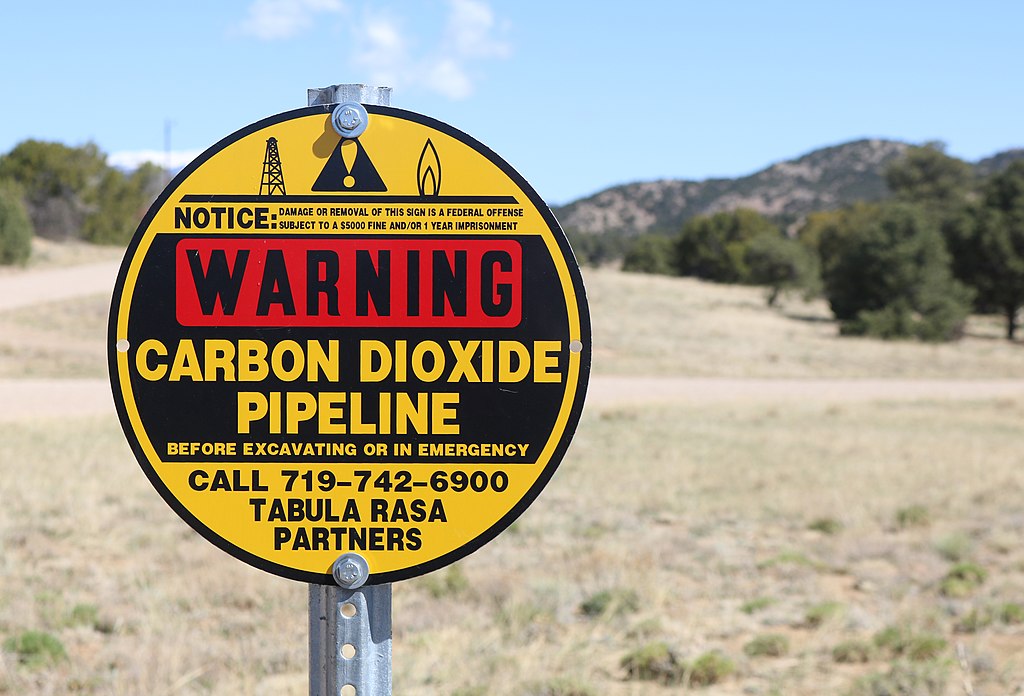

For years, wages in Iowa have stagnated for everyone, and the racial wealth gap has exacerbated inequalities embedded in our economic system. In particular, Black, Brown, and Indigenous workers have been pushed to the economic margins by systemic inequality in our tax code. Meanwhile, the climate crisis continues to put all Iowa families at risk as storms like the 2020 derecho devastate working neighborhoods.

As Catholic nuns with decades of ministry experience in Iowa, we have worked closely with those most impacted by Iowa’s inequities. Union workers, immigrant communities, hungry children, and houseless families have turned to social services, religious communities, and mutual aid efforts because of our state and federal government’s misplaced priorities.

Continue Reading...