As the Iowa legislature considers extending sales tax to internet purchases and some other goods and services that are now exempt, Randy Bauer explains what’s at stake and other factors that have eroded sales tax revenues. -promoted by desmoinesdem

For many American taxpayers, April 17 is understood as the 2018 due date for federal (and many state) income taxes. It also features prominently in state and local tax discussions, as it is the date when the U.S. Supreme Court will hear oral arguments in a case that may impact on remote sales and use tax collection practices for state and local governments.

While that would be a major development and boon to many state and local governments, it is really only part of the story.

Supreme Court Limits on Collection of Sales Tax by Remote Sellers

The case to be heard next month, South Dakota vs. Wayfair, concerns sales tax collection related to sales conducted over the Internet. Two 20th century Supreme Court cases, Bellas Hess v. Illinois (1967) and Quill v. North Dakota (1992) have established limits on government’s ability to compel collection of sales taxes on remote transactions. In the Bellas Hess case, the high court determined that physical presence in a state was necessary to require the seller to collect sales tax for catalogue sales transactions conducted via phone or mail. As the catalogue sales era declined and the Internet became a more important part of commerce, the court extended this “nexus via physical presence” standard to include e-commerce transactions via Quill.

Background on Major State and Local Tax Revenue Sources

In general, the three largest revenue sources for state and local governments are property taxes (the largest local government source) and individual income and sales and use taxes. In the last few decades, sales taxes have become the largest state tax revenue source, and several states have sought to increase the use of this consumption-based tax source while reducing the use of income-based taxes.

There are credible arguments for relying on a consumption-based tax. For one, the tax is collected in generally small increments, which allows taxpayers to base purchasing decisions around their ability to pay. These small incremental payments also reduce the “sticker shock” that often comes from large lump sum payments of property and individual income taxes. Consumption taxes will also be borne by nearly all consumers – unlike, say, income taxes that can often be avoided by a large number of citizens.

That said, there is no “perfect tax,” and sales taxes are no different. All taxes will have a negative impact on economic activity (the “deadweight loss” associated with the increased cost for goods and services subject to tax). Sales taxes are also considered to be something of a regressive tax, in that lower income individuals and households tend to pay a higher percentage of their income as tax. Some of this concern is reflected in exemptions for broad categories of goods and services – all states exempt prescription drugs from sales tax, and a majority do the same for food. It is also possible to use refundable credits via the individual income tax to reimburse lower income taxpayers, as is done in several states.

Sales Tax and e-Commerce

As Amazon boxes on our doorsteps have become a ubiquitous part of everyday commerce, the revenue loss associated with the Quill case has become a significant concern to state and local governments. As Supreme Court Justice Anthony Kennedy noted in a 2015 concurring opinion (where he signaled his willingness to reconsider the decision in Quill), “When the Court decided Quill, mail-order sales in the United States totaled $180 billion. But in 1992, the Internet was in its infancy. By 2008, e-commerce sales alone totaled $3.16 trillion per year in the United States.”

That number continues to grow – according to Internet Retailer, U.S. web sales in 2016 reached $394.86 billion, or 11.7 percent of the nation’s total retail sales ($4.846 trillion).

State Strategies to Heighten Sales Tax Collection

In the face of this significant revenue loss, states have pursued a number of strategies to deal with the revenue loss. The first strategy was to seek to address the Court’s concerns in Quill, by working to simplify and develop greater consistency in sales tax statutes, primarily around definitions and other requirements directed at those who collect the tax.

The Streamlined Sales Tax Initiative was initiated by the National Governors Association (NGA) and the National Conference of State Legislatures (NCSL) in 1999. The goal was to increase uniformity that would either lead to greater vendor voluntary collection or the reconsideration of the two Supreme Court decisions. As of 2017, 24 states participate in the program as full members. While this is a significant number of states, several major states (such as California, Texas and New York) do not, which limits the agreement’s impact. While it is true that there are vendors who are voluntarily complying with this initiative and collecting tax on behalf of the participating states, it will likely never reach the necessary “critical mass” from a compliance perspective.

The next foray came via the U.S. Congress. Via its authority to regulate interstate commerce, Congress could establish a national requirement for collection of state and local sales taxes on purchases via the Internet (or, for that matter, on catalogue and phone sales as well). Bills have been introduced for many years in Congress to do just that, and they have, in recent years, also received support from major “bricks and mortar” retailers who argue the existing taxing structure creates a double standard that harms this segment of the retail market.

From a tax policy perspective, the point is well taken: a commonly accepted principle of taxation is “horizontal equity” – that taxpayers in similar circumstances should be treated fairly. When local retail establishments are required to collect this tax but remote sellers are not, the resulting price disparity is a perfect example of horizontal inequity.

To date, no version of the “Marketplace Fairness Act” has made its way through the legislative process. It came (somewhat) close in 2013, when the bill was passed by the Senate on a bipartisan 69-27 vote. However, it did not clear the House, and current efforts to revive the bill do not look promising.

It is important to remember that sales (or use) taxes are nearly always owed on these remote purchases – the issue isn’t one of creating a new tax but getting compliance with payment of the existing tax. As previously noted, an advantage of the sales tax is it is paid in hundreds/thousands/millions of separate transactions. The downside is that it is administratively difficult to collect the tax from the hundreds/thousands/millions of consumers who, if the tax isn’t collected at the time of purchase, are to remit it to comply with state and local sales tax statutes.

As a result, state legislatures have resorted to a variety of statutory strategies to induce sales tax collection. Some of the first attempts related to creating nexus beyond mere physical presence. This was initiated by the State of New York in 2008, often referred to as the “Amazon tax.” Under the New York State statute, a rebuttable presumption is created that a nonresident Internet seller has nexus with the State for sales/use tax purposes if (i) the nonresident has agreements with in-state companies whereby potential customers are referred to the nonresident, and (ii) the nonresident’s gross receipts from customers under such an agreement exceed $10,000 during the previous four quarters. According to a report by the New York State Comptroller, since the law’s inception, online retailers remitted $360 million in sales taxes (on over $4 billion in taxable online sales) as of February 2012.

Since that first state foray – and the litigation that followed – other states have also considered and/or adopted similar legislation. It could be argued that the multiple state efforts to create “Amazon nexus” has proven successful, as Amazon is (as of April 1, 2017) collecting sales tax on sales in all 50 states. Additional attempts to create “economic nexus” (where the amount of sales into a state alone creates sufficient grounds to require collection of the tax) have become popular, with many states enacting this type of statute.

State Efforts to Create an Economic Nexus Standard to Compel Collection of Sales Tax

The economic nexus standard was first adopted by the States of Alabama and South Dakota – and South Dakota legislative and policymakers have been up-front about the fact that the economic nexus statute was crafted as a method to bring the issues of Quill back before the Supreme Court. Several other states passed economic nexus standards last year, including Indiana, Maine, North Dakota, Ohio, Rhode Island, Tennessee (done by rule) and Wyoming. The South Dakota statute is now the one before the high court.

A somewhat different state strategy has been undertaken by the State of Colorado, which enacted a law focused on enticing retailers to collect the tax or face significant paperwork requirements. The law, which survived court challenges (including the U.S. Supreme Court declining to review it, and then U.S. Court of Appeals Judge Neil Gorsuch writing a concurring opinion strongly implying that, given the opportunity, the Supreme Court should overrule Quill), requires retailers that do not collect sales taxes to file a report with the State Department of Revenue on how much their Colorado customers have purchased and to inform customers that they may owe state taxes on the purchases. The law requires large online retailers to send customers a notice every time they buy something to explain that they may owe use tax; if the customer makes more than $500 a year in purchases, the retailer must also send them an annual summary of their purchases. The seller must also file an annual report with the State detailing customer name, billing and shipping addresses and the total amount spent each year.

Other states have replicated this approach. Advocates for the policy believe that it will better inform consumers of their obligation to pay use tax on their out-of-state purchases or lead to sellers voluntarily collecting the tax to escape the reporting requirements (for both them and their customers). States who adopted Colorado-type reporting standards (all effective July 1, 2017) include Alabama, Louisiana and Rhode Island.

What’s At Stake?

The revenue at stake in this area is significant. While the estimates of lost revenue vary considerably (and some of the “lost revenue” estimates include Amazon sales that are now applying sales tax in all 50 states), there is little doubt that it is “real money” to state and local governments. The federal General Accountability Office (GAO) estimated that state and local governments could have collected up to $13 billion more in 2017 if they’d been allowed to require sales tax payments from online merchants and other remote sellers. That said, that estimate comprises a significant amount of business-to-business sales – and pretty good data suggests there already is reasonable compliance by businesses through payment of use tax on at least the majority of these transactions.

Besides the obvious issues related to revenue loss and impact on the economy, what are the issues on both sides of this controversy? Those who support the Quill standard (or at least something other than unfettered state ability to compel collection of the tax by sellers) argue that the thousands of different taxing jurisdictions and definitions make collecting the tax overly burdensome.

It is notable, however, that in the years since Quill, a number of Internet-based businesses have cropped up to handle the administrative side of determining the tax that is owed and applying it to electronic transactions. Meanwhile, the thousands of vendors who already comply with varying state and local sales taxes suggest this is not unsolvable. In fact, much of the effort on the seller side has been focused on providing some reimbursement for collection of the tax – which suggests the issue is more one of economics than legal compliance. While opponents also argue that the burden will fall disproportionately on small businesses, it is notable that the state “economic nexus” statutes to date have included an exemption for businesses with low levels of sales into a state.

On the other side of the argument, supporters of collection point to Justice Kennedy, when he noted, “There is a powerful case to be made that a retailer doing extensive business within a State has a sufficiently ‘substantial nexus’ to justify imposing some minor tax-collection duty, even if that business is done through mail or the Internet.” After all, “interstate commerce may be required to pay its fair share of state taxes.” D.H. Holmes Co. v. McNamara, 486 U.S. 24, 31 (1988).

My guess is that the Supreme Court will, in some way, overturn its ruling from Quill – perhaps via the “substantial nexus” approach Justice Kennedy suggests. The question will be how far the court goes and whether their action leads the Congress to consider finally taking action to create something of a national standard for nexus and the amount of obligation to collect the tax that might be imposed on sellers.

While any greater latitude for state and local governments in collecting these taxes will be welcome news, my personal belief is that there are bigger issues at play relating to sales tax and the U.S. economy, and some of the focus on South Dakota v. Wayfair blinds policymakers to more fundamental issues.

Sales Tax Erosion of the Base

The fact is that the sales tax base has been eroding for decades, using common measures such as sales tax collections as a share of personal income. While state and local governments have attempted to ameliorate these declines through rate increases, that creates its own set of problems.

Why is this happening? There are several reasons. For one thing, legislatures continue to provide new or expanded exemptions from the tax (after all, most every legislator loves to cut taxes). In Iowa, a good example is the broadened sales tax exemption for supplies used in the manufacturing process. When passed in 2016, that exemption was estimated to reduce revenue by approximately $29 million a year, but it now looks like a revenue loss in the neighborhood of $100 million a year.

Some of the reduction in sales tax revenue is simply a function of demographics. As a population, we continue to get older – and as we get older, we generally make fewer purchases, per capita, that are subject to the sales tax.

Sales Tax Statutory Construction

An even bigger problem, in my estimation, concerns how state sales tax statutes are structured. The state sales tax statues generally were written in the early part of the 20th century, when most consumption consisted of tangible goods. As a result, nearly all state sales tax statute will broadly tax all tangible goods – the standard generally is that tangible goods are presumed to be subject to tax unless specifically exempted. On the other hand, relatively few services were a part of everyday commerce; as a result, the statutes generally presume that services are not subject to tax unless specifically enumerated.

This “double standard” related to sales tax on consumption has become increasingly more important, as what we consume has gradually – but dramatically – shifted from goods to services. Fifty years ago, about two-thirds of consumption was tangible goods, but now about two-thirds is services. Absent legislative action to change the standard of presumption related to consumption subject to the sales tax, states have had to rely on the often heavy lift of identifying specific services to be subject to tax. This is a difficult process, and few states (generally only those with the greatest reliance on sales tax) have been able to broadly apply the tax to services.

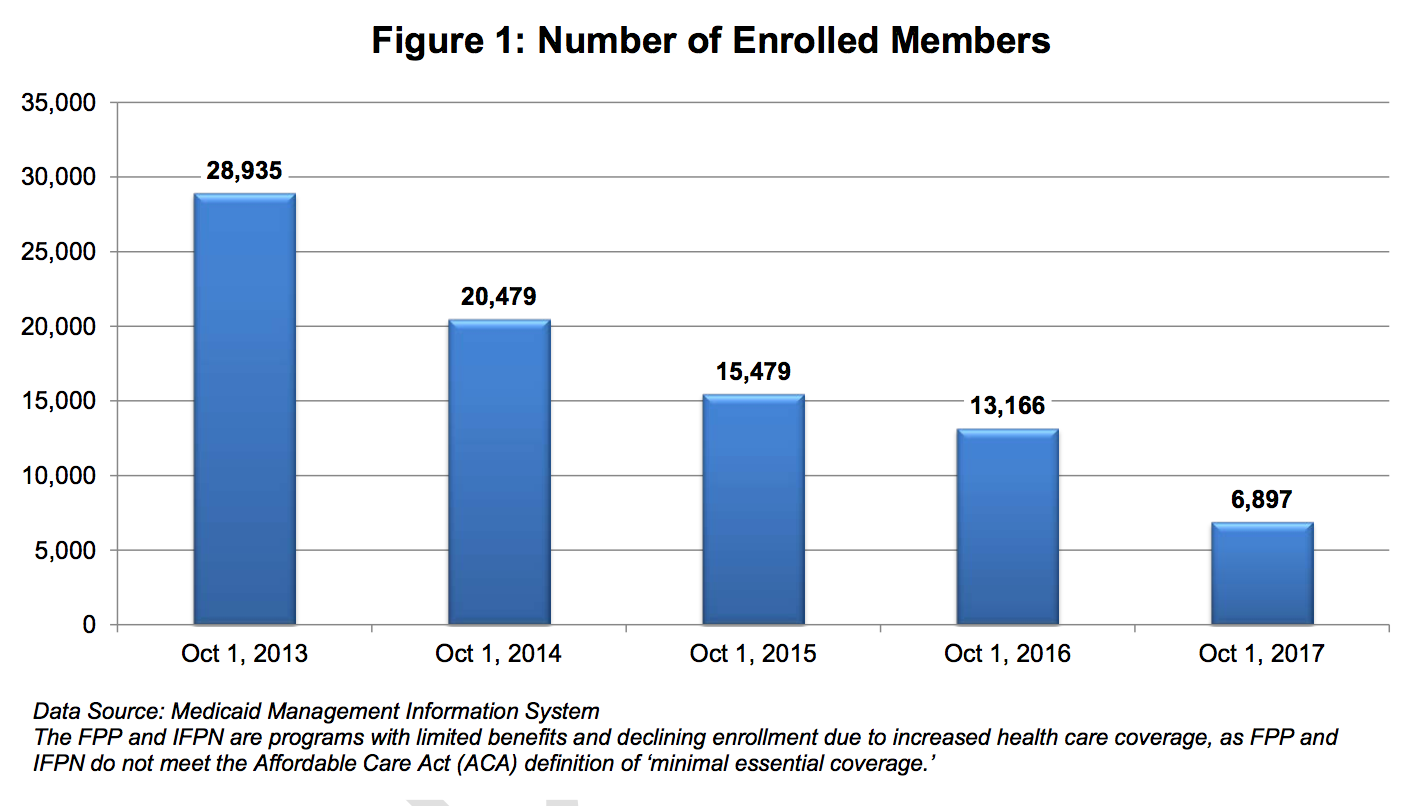

This trend is likely to continue in the coming years. For one thing, health care has become a huge service industry in this country. An example of how health care and the consumption tax code have played out in Iowa is instructive. In 1999, the Iowa legislature passed and Governor Tom Vilsack signed into law a sales tax exemption for goods and services related to non-profit hospitals. At the time of passage, the fiscal note suggested the annual cost of exempting these services (granted, some goods as well, but mostly services) was about $15 million. However, when the Department of Revenue issued its tax expenditure report in 2000, the cost was now estimated at $53.7 million. It ballooned to $108.4 million in 2005, $125.4 million in 2010 and $160.6 million in 2015.

Several governors – Republicans and Democrats alike – have made attempts to significantly broaden the sales tax base to include more services. However, to date, those efforts have been largely unsuccessful.

If states are to rely on consumption taxes as their primary revenue source, they will have to come to grips with a system that has mostly ignored well over half of what is actually consumed. While changes to collection of taxes from Internet sales are nice, it is still only improving collection rates on a minority of consumption – and that is, in the long run, a losing proposition for state and local governments.

Randall Bauer is a director in the Management and Budget Consulting practice for the PFM Group. Since 2005, he has led its state and local government tax policy practice. He has numbered nearly half the state and many large local governments among his clients. Prior to joining PFM, he spent 18 years in state government, including serving for seven years as Governor Tom Vilsack’s State Budget Director.