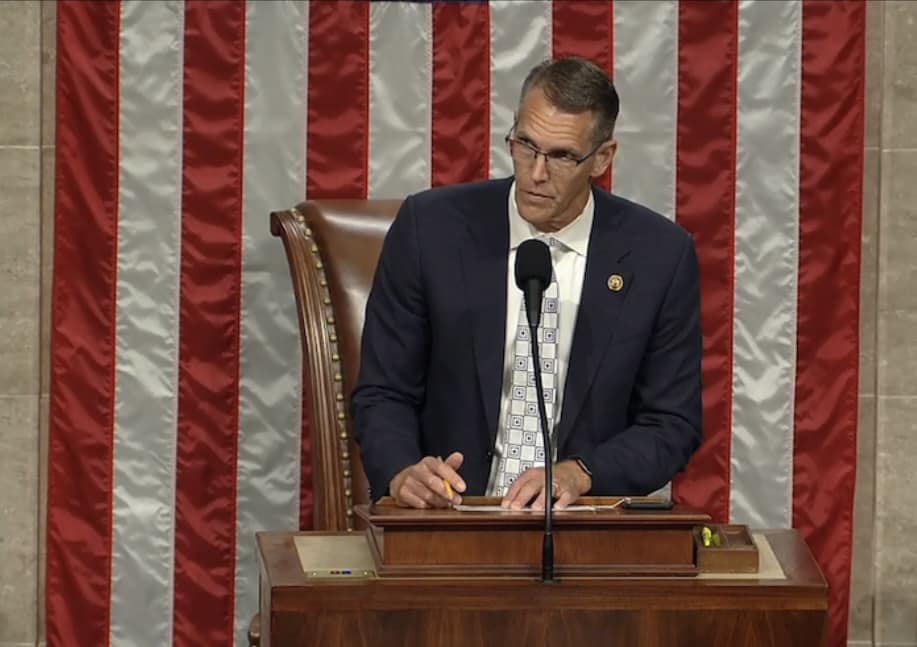

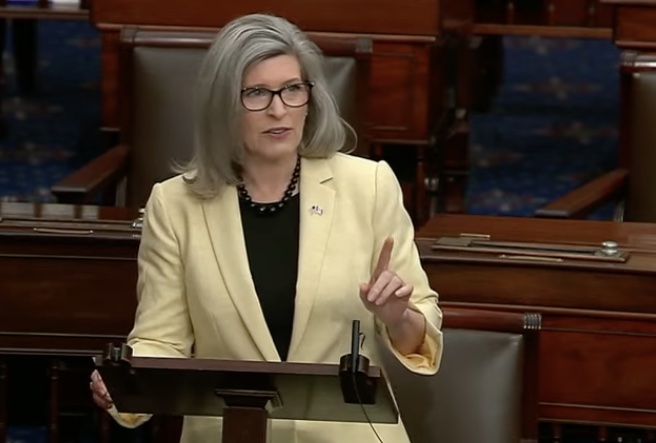

The bill President Donald Trump signed on November 12 to end the longest federal government shutdown includes $16 million for designated projects in Iowa, according to Bleeding Heartland’s analysis of a Senate Appropriations Committee report. U.S. Senators Joni Ernst and Chuck Grassley were among 60 senators who approved the funding bill on November 10. All four U.S. House Republicans from Iowa—Mariannette Miller-Meeks (IA-01), Ashley Hinson (IA-02), Zach Nunn (IA-03), and Randy Feenstra (IA-04)—were among the 22 representatives who voted for the bill two days later.

The bill funds most federal government operations through January 30, 2026. A few agencies and programs, including the U.S. Department of Agriculture, are funded through the end of the federal fiscal year on September 30, 2026.

Miller-Meeks, Hinson, and Nunn had all requested “community project funding” through various USDA programs. The final bill included eleven of those earmarked projects: five in Hinson’s district, and three each sought by Miller-Meeks and Nunn.

The 36 counties in IA-04 will receive none of the earmarked funding, because for the fifth straight year, Feenstra declined to submit any requests for community projects. Ernst and Grassley have not participated in the earmarks process in recent years either. Abstaining from the process does not save any taxpayer dollars; it only ensures that the federal funds allocated for Congressionally-directed spending flow to other members’ districts.

These are the first earmarks Iowa will receive from a government funding bill since 2024. Miller-Meeks, Hinson, and Nunn submitted a combined $115 million in community project requests for fiscal year 2025, but the appropriations bill Congress approved in March of this year—with Iowa’s whole delegation voting in favor—included no money for any earmarked projects.

Miller-Meeks, Hinson, and Nunn each submitted fifteen community project funding requests (the maximum allowed for each U.S. House member) for the current fiscal year. Most of them were repeated from last year. The fate of the other projects—which include improvements to roads, flood mitigation, higher education, and airports—won’t be known until Congress approves and Trump signs final appropriations bills for fiscal year 2026.

Continue Reading...