Talk about a bolt from the blue:

A memo from auditors investigating irregularities in a state tax-credit program for filmmaking paint a picture of movie producers and film executives taking personal advantage of the program and state administrators paying little attention.

The director of the Iowa Department of Economic Development, Mike Tramontina, abruptly resigned Friday after allegations of mismanagement of the program surfaced. The department oversees the Iowa Film Office. The manager of that office, Tom Wheeler, was placed on paid administrative leave.

The departure of Tramontina, who was appointed to the post by Gov. Chet Culver in 2007, came after preliminary findings from auditors looking into allegations that filmmakers had purchased luxury vehicles for themselves.

According to the memo obtained by The Des Moines Register, auditors found a long list of bookkeeping lapses and poor oversight in the program, which has spent $32 million on tax credits for 20 film projects since its inception in 2007. The program was aimed at promoting filmmaking in Iowa as a way to contribute to the local and state economy.

The governor’s office announced Tramontina’s resignation at 4:56 pm on Friday. Culver also suspended the tax credit program until auditors complete a review of it.

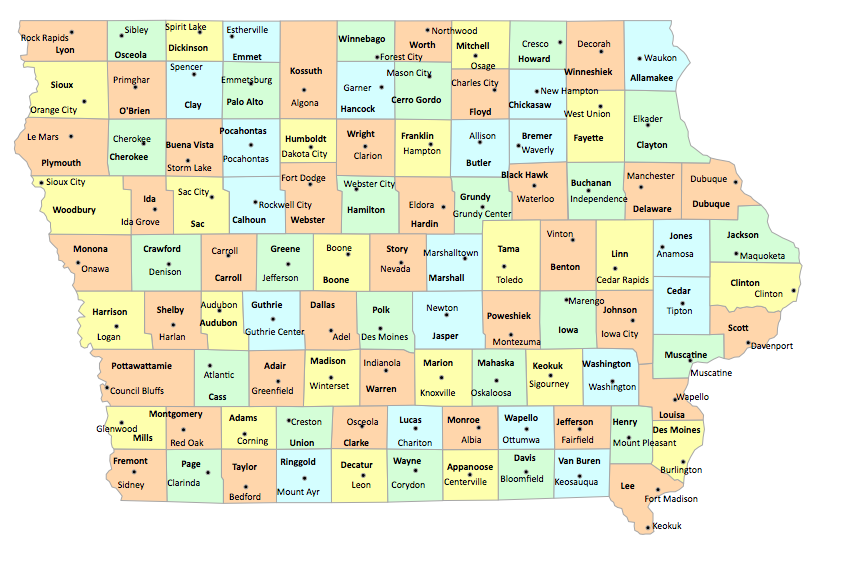

State Senator Tom Courtney, a Democrat from Burlington, told the Des Moines Register “he talked to state officials about problems with the movie tax credits about a month ago, when labor officials complained that few Iowans were getting hired to work on the movies.” Courtney raised those concerns again in a meeting with the Iowa Economic Development Board the day before Tramontina resigned:

“I’m hearing nothing but complaints that workers are being brought in from other states” during film productions in Iowa, Courtney said. “I don’t imagine we have a lot of Clint Eastwoods running around, but with a little training, we could be doing many of those jobs.”

Michael Tramontina, the state’s economic development leader, said he couldn’t put a number on how many jobs are created, since many are temporary – from contractors used to build sets to caterers and “extra” actors.

“Anecdotally from the film industry, it ranges from 20 to 60 percent Iowans” employed on films produced in Iowa, Tramontina said. […]

Tramontina said the agency is working to develop “employment thresholds” for a film, but hitting a number is complicated.

Employment requirements should depend on the kind of film being made – whether it’s a feature film being made over three to six months or a TV series that might run for years. […]

Courtney said lawmakers might need to address closing what he called “an open door” in film tax credits if Tramontina’s agency is unable to do it. He said most Iowa economic development incentives carry job-creation requirements. “Iowa has a bright future in the film industry, but we have to help the people who live here.”

While Republicans harp on the need to cut spending further, it’s equally important to subject every tax credit to scrutiny. The Iowa Policy Project has found that expenditures on tax credits for business have “skyrocketed” in recent years, far outstripping the rate of increase in spending from Iowa’s general fund. These tax credits should be on the table as legislators look for ways to balance the budget.

Continue Reading...