The good news is, the federal government won’t shut down before the end of the current fiscal year on September 30, 2016. The bad news is, members of Congress snuck some awful provisions in the “omnibus” budget bill and package of tax cut or tax credit extensions that just cleared the U.S. House and Senate. You know leaders aren’t proud when they bury news about a deal during another event occupying the political world’s attention, in this case Tuesday night’s Republican presidential debate. I enclose below background on key provisions in the bills, as well as statements from the Iowans in Congress. I will update this post as needed.

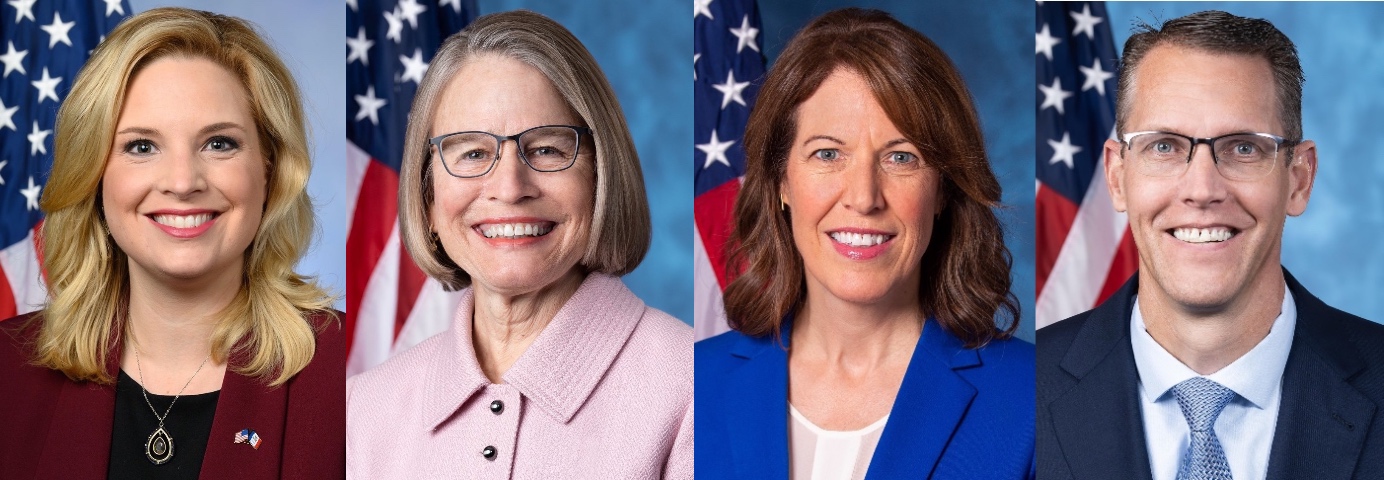

The House held separate votes on the “tax extenders” and the omnibus. Republicans were nearly united in support of the tax bill (confusingly named “On Concurring in Senate Amdt with Amdt Specified in Section 3(b) of H.Res. 566”), which passed yesterday by 318 votes to 109 (roll call). The Democratic caucus was split; Naomi Jagoda and Cristina Marcos reported for The Hill that House Democratic leaders “opposed the tax package” but “did not whip their members against it.” Republicans Rod Blum (IA-01), David Young (IA-03), and Steve King (IA-04) all voted for the tax extenders; so did Democratic Representative Dave Loebsack (IA-02), one of 77 House Democrats to do so.

Loebsack was the only Iowan to vote for the omnibus bill, which easily passed this morning by 316 votes to 113 (roll call). Most of the Democratic caucus supported the bill that keeps the federal government open for at least nine more months; just 18 Democrats voted against it.

Although House Speaker Paul Ryan and his team persuaded 150 Republicans to vote for the budget measure, 95 Republicans opposed it, including all three Iowans. Blum and Young appear to have concluded that the bill was simply too expensive. King’s main objection was that none of his nine amendments were included in the final deal. Click through to read the texts of those amendments, which would have barred the use of appropriated funds for: enforcing the 2010 Affordable Care Act (health care reform law); implementing President Barack Obama’s executive orders to provide temporary protection against deportation for some immigrants who entered the country without permission; enforcing the U.S. Supreme Court decision that legalized same-sex marriage nationwide; supporting any activities of Planned Parenthood Federation of America or any of its clinics, affiliates, or successors; implementing or enforcing any change to the U.S. EPA’s Waters of the United States rule; resettling refugees; implementing the multilateral deal struck earlier this year to prevent Iran from obtaining nuclear weapons; implementing any regulation that stemmed from the recent international agreement to combat climate change; or expanding the use of H-2B visas.

The Senate combined the tax extenders and budget bills into one package, which passed this morning by 65 votes to 33 (roll call). Iowa’s Senators Chuck Grassley and Joni Ernst both voted no; in the statements I’ve enclosed below, Grassley went into greater detail about his reasons for opposing the package. However, earlier this week he released a separate statement bragging about some of the provisions he helped to insert in the tax legislation. Members of Congress from both parties use that sleight of hand.

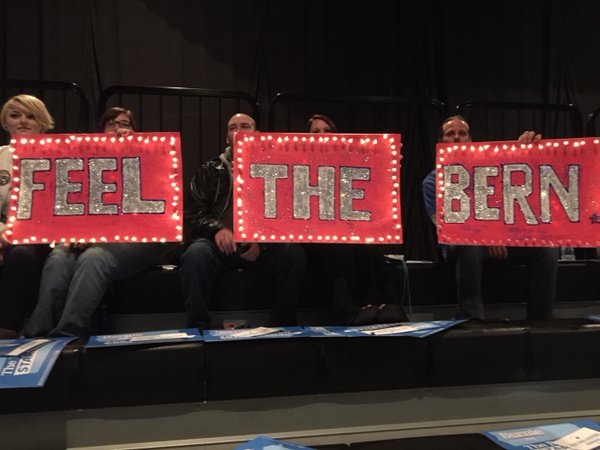

Among the presidential candidates, Bernie Sanders, Ted Cruz, and Rand Paul voted against the omnibus, Lindsey Graham voted for it, and unbelievably, Marco Rubio missed the vote. What is wrong with this guy? He “has missed more than half of the Senate’s votes since October,” Jordain Carney reported for The Hill. I think not showing up for Senate work will hurt Rubio in Iowa, though not having a strong field operation will hurt him more.

The Senate is now adjourned until January 11 and the House until January 5. During the winter recess, Bleeding Heartland will catch up on some of the Iowa Congressional voting not covered here during the late summer and fall.

Continue Reading...