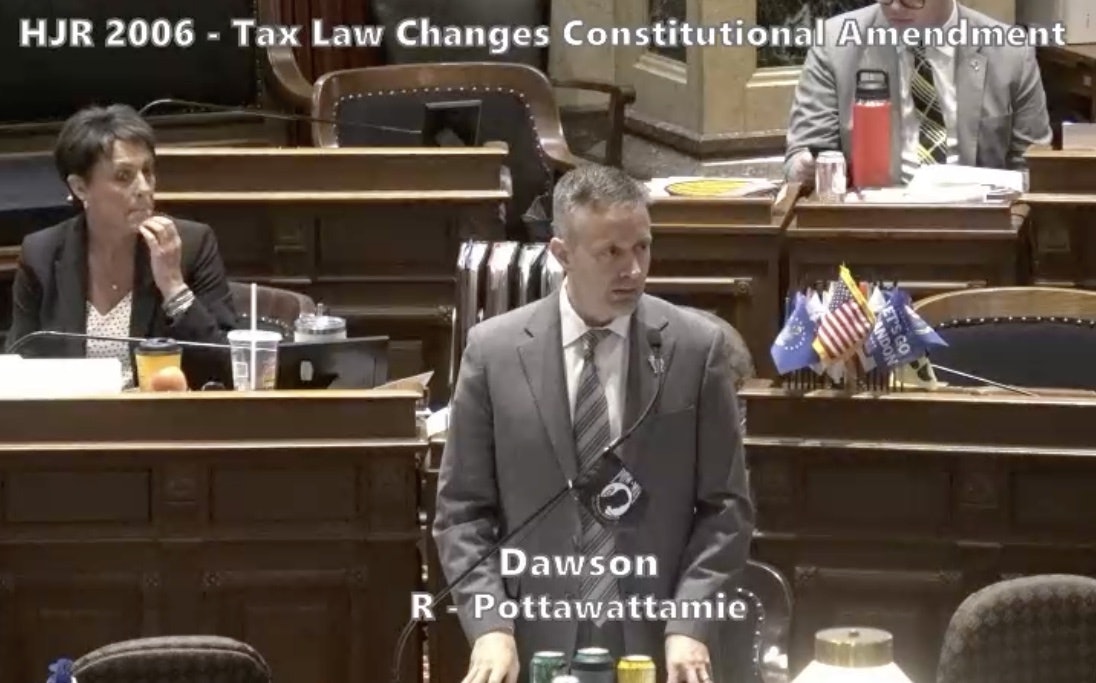

State Senator Dan Dawson floor manages a proposed constitutional amendment on April 10.

Rick Morain is the former publisher and owner of the Jefferson Herald, for which he writes a regular column.

Tax bills in the Iowa legislature have always been approved or disapproved by simple majorities. If most legislators want to raise taxes, or lower them, they do it the usual way: take a vote, up or down, and whichever side gets the most votes wins. That’s how democracy works.

But this year, Republican legislators voted to change that.

First the Iowa House in late March, and then the Iowa Senate earlier this month, approved House Joint Resolution 2006, a proposed amendment to the Iowa Constitution that would require a two-thirds majority in each house of the legislature to raise state income taxes.

Changing the state’s constitution isn’t beanbag. Proposals to do that need to be approved in exactly the same wording by two successive sessions of the Iowa legislature, then be approved by voters in a statewide referendum.

That means before this language could be enshrined in the Iowa Constitution, the legislature would need to pass the amendment in 2025 or 2026, and a majority of Iowa voters would need to approve it. That’s a heavy lift.

But not as heavy as trying to increase the state income tax if the amendment passes. The Iowa House has 100 members, and the Iowa Senate has 50. Do the math. It would take only 34 House members, or seventeen senators, to block a tax bill that most legislators support.

That’s not House and Senate members—it’s House or Senate members. Even if, say, the House were to support an income tax increase unanimously, with all 100 members, just seventeen senators could block it.

Amendments to the Iowa Constitution do not require the governor’s signature. If the legislature OKs the proposed amendment in 2025 or 2026, then it would go to the voters for their decision.

Anti-tax forces in Iowa are doggedly persistent. They’ve been trying to wedge a supermajority requirement for income tax increases into the Iowa Constitution for at least the past 25 years. (In 1999, Iowa voters narrowly rejected a Republican-backed amendment that “would have required a three-fifths vote of all members of the legislature to increase income or sales taxes or to establish a new state tax.”)

Never mind how desperately Iowa might need more revenue at some point in the future: the Holy Grail is to assure that a legislator who opposes an increase gets to outbalance two legislators who favor it.

That’s not democracy. Why should my senator, and sixteen others like him, theoretically be empowered to overrule 33 who see a need for an increase? And to maintain that anti-tax wall into the future forever?

Economic cycles go up and down. They always have, and Iowa doesn’t control the national economy. A time will come when the state needs more revenue than its current tax structure can provide. When that time arrives, if the Iowa Constitution prevents the legislature from raising income taxes even for the short term, legislators will be forced to turn to the sales tax or property taxes for the necessary revenue. Neither option is preferable to the income tax in terms of individual ability to pay.

The U.S. Constitution requires only a simple majority of members of Congress to declare war. But most Iowa legislators think it should take two-thirds of their colleagues to raise state income taxes. Does that make sense?

One more note: the proposed amendment doesn’t require a two-thirds majority to lower state income taxes. The supermajority requirement would kick in only to raise them.

In 1789, in a letter to an acquaintance following the Constitutional Convention in Philadephia, Benjamin Franklin wrote, “Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.”

For most Iowa legislators the goal appears to be the death of taxes.

Editor’s note from Laura Belin: Under House Joint Resolution 2006, future legislatures would be able to raise the regressive sales tax by simple majority vote. A two-thirds supermajority would be required only for any “bill that increases the individual income tax rate or the corporate income tax rate, or the rate of any other type of tax based upon income or legal and special reserves.”

A separate constitutional amendment, also approved in both chambers this year on party-line votes, would prevent Iowa from returning to a progressive tax structure, even with supermajority approval. Senate Joint Resolution 2004 forbids a graduated income tax rate, stating “There shall not be more than one income tax rate above zero” for individuals. That proposal could also appear on a statewide ballot if both chambers pass it again in 2025 or 2026.

Both constitutional amendments advanced from the Iowa House and Senate on straight party-line votes.

1 Comment

No title

Great post. You did not mention a book that was recently published, “The Power to Destroy: How the Antitax Movement Hijacked America,” by Michael Graetz. I have not read it, but I am familiar with the author, a noted professor at Columbia and Yale. You also omit any reference to the experience of Kansas many years ago. I fear Iowa must follow that same path until our public schools flounder.

jschmidt53 Tue 23 Apr 8:01 PM