Iowa’s all-Republican delegation voted the same way on almost every bill that came before both chambers during the 118th Congress, which wrapped up its work in the early hours of December 21. But one of the last bills sent to President Joe Biden, the Social Security Fairness Act, revealed an unusual disagreement among the Iowans serving in the U.S. House and Senate.

When the House approved the bill by 327 votes to 75 in November, U.S. Representatives Mariannette Miller-Meeks (IA-01), Ashley Hinson (IA-02), Zach Nunn (IA-03), and Randy Feenstra (IA-04) were part of the bipartisan majority.

When the Senate passed the bill by 76 votes to 20 shortly after midnight on December 21, Senators Chuck Grassley and Joni Ernst were among the 20 Republicans who voted no.

The Iowans’ comments on the Social Security Fairness Act illustrate how differently politicians with similar ideologies can view a complex public policy fix.

BILL DESIGNED TO HELP PUBLIC SECTOR WORKERS

Social Security is the archetypal “third rail” in U.S. politics. Any proposed change to future benefits is risky, giving fodder for attack ads in the next election campaign.

Jeanne Sahadi explained in this article for CNN that the Social Security Fairness Act “eliminates two policies that have reduced Social Security benefits for public service employees.”

The workers affected are those who are eligible for government pensions from jobs where they didn’t pay into Social Security but who did pay into the program through other jobs or whose spouses did so.

The first is the Windfall Elimination Provision (WEP). “The WEP reduces benefits for retired or disabled workers who have fewer than 30 years of significant earnings from employment covered by Social Security if they also receive pensions on the basis of noncovered employment,” according to the Congressional Budget Office.

The second provision that will be eliminated is the Government Pension Offset (GPO). “The GPO reduces the spousal or surviving spousal benefits of people who receive pensions on the basis of noncovered employment,” CBO noted.

For decades, some Democrats and Republicans in Congress have worked on legislative fixes to increase benefits for some public sector retirees and their spouses or survivors.

Retirees in dozens of other states, listed in this article by Jennifer Shutt, are more affected than Iowans by the provisions slated for elimination. But the more than half a million Iowans on Social Security include thousands of public sector workers who will receive more in benefits if Biden signs the Social Security Fairness Act into law.

The nonpartisan Congressional Research Service estimated that the Windfall Elimination Provision affected about 8,302 Iowans or 1.2 percent of the state’s Social Security beneficiaries, as of December 2023.

A separate Congressional Research Service report estimated that the Government Pension Offset provision affected 1,914 Iowans (896 spouses and 1,018 widows or widowers), as of December 2023.

HOUSE MEMBERS TOUT VICTORY FOR PUBLIC SERVANTS

Iowa’s U.S. House members don’t publicly comment on every bill that comes up for a vote. But all were loud and proud about their support for this one.

Feenstra’s office said in a November 13 news release that he voted for the bill “to ensure that public servants like teachers, police officers, and firefighters receive the full Social Security benefits that they have earned.”

“Our seniors deserve to receive the Social Security benefits they have earned after a lifetime of hard work. But, for too long, public servants like teachers, police officers, and firefighters have been wrongfully denied their full benefits,” said Rep. Feenstra. “That’s why I voted for the Social Security Fairness Act to repeal outdated rules that have long prevented Iowa’s teachers, police officers, and firefighters from receiving the full Social Security benefits that they worked so hard for and deserve. I will always protect Social Security and Medicare for our seniors.”

Nunn recorded a video for social media in November to highlight his work on the legislation.

I am 100% committed to protecting your Social Security benefits. pic.twitter.com/VoLVYiLzG0

— Congressman Zach Nunn (@ZachNunn) November 16, 2024

My transcript:

Let me be clear: the government made a commitment to Americans when it created Social Security and Medicare. I am 100 percent committed to protecting that promise.

Each year, thousands of Iowans dedicate their careers to public service as teachers, first responders, transportation workers, and so much more. Unfortunately, when these folks retire, many of them are cheated out of the Social Security benefits they paid into.

That’s why I’ve been fighting for the Social Security Fairness Act, which would fix this disparity, so that public servants can retire with dignity. This week the House of Representatives passed this bill with my support, and I am going to do everything in my power to make sure that your benefits are there when you retire.

Miller-Meeks said in a December 21 Facebook post, “With the Senate’s passage of the Social Security Fairness Act, this critical bill now heads to the President’s desk. This is a victory for Iowa’s firefighters, teachers, police officers, and other public servants who deserve the Social Security benefits they’ve earned. Proud to help right this wrong.”

Hinson celebrated with a longer Facebook post on December 21:

Big News! The Social Security Fairness Act passed both the House and Senate and is headed to the President’s desk.

This legislation ensures public servants receive their full Social Security benefits. I was a proud cosponsor of this bill and worked to build support for it ahead of a floor vote.

Iowa teachers, police officers, first responders, and other public servants have dedicated their lives to bettering our communities and keeping our workplaces and schools safe. After years of service, many look forward to their well-earned retirement. Unfortunately, our public servants are unfairly punished through reduced Social Security benefits – threatening the livelihoods of millions of retirees and fixed-income seniors.

Currently, the Government Pension Offset and the Windfall Elimination Provision unfairly reduce the earned retirement, disability, spousal, and survivor benefits of lower-paid public employees. It is time to fix this, especially now as record inflation squeezes the budgets of Iowans on fixed incomes.

The Social Security Fairness Act will immediately restore the benefits millions of retired public servants rely on, making long-term financial security a reality.

This will have a meaningful impact for retirees in Iowa and across the country who dedicated themselves to public service and bettering our communities!

Iowa’s senior senator had a very different take.

“THAT’S SIMPLY NOT FAIR TO THE AVERAGE PRIVATE SECTOR WORKER”

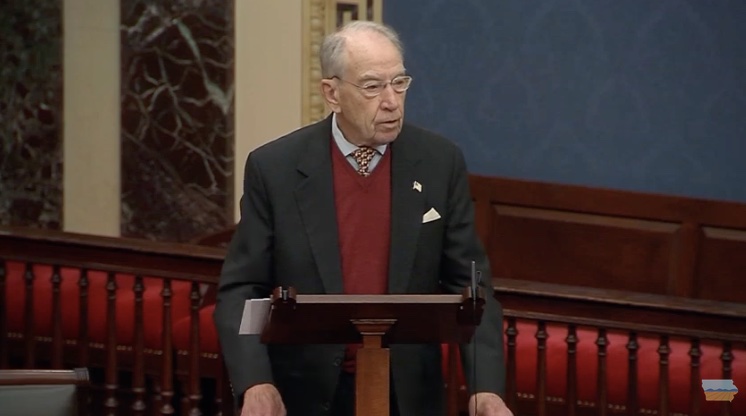

Grassley made his case against the Social Security Fairness Act during a Senate floor speech on December 20.

Grassley leveled three arguments against the bill. First, he said the $200 billion cost over ten years (actually just under $196 billion) would make the Social Security Trust Fund insolvent six months earlier than now expected. From his prepared remarks:

That fund is speeding toward insolvency.

Come 2033, seniors will automatically see their retirement benefits cut 25 percent absent congressional action.

Congress should be working toward a consensus on legislation to ensure this never happens.

Instead, we’re on the cusp of enacting significant changes to Social Security that will result in larger cuts that would normally happen in 2033, but now happen sooner.

If the bill before us is enacted, a typical senior would see their benefits cut by an additional $4,000 – and six months earlier than that date that’s predicted now to be the year 2033.

Second, Grassley asserted the bill would be unfair to private sector workers by giving those who worked in the public sector overly generous benefits. From his prepared remarks:

Let’s be crystal clear: this bill would increase unfairness in how Social Security benefits are calculated.

The Social Security Windfall Elimination Provision, WEP as it’s called around here, which this bill repeals, addresses a real issue that exists in how the Social Security benefit formula works, or more, how it fails to work, when a government employee spends most of their career in non-Social Security covered positions.

The Social Security benefit formula is designed to be progressive.

That is, it provides a low-income worker a more generous benefit relative to their contributions compared to a middle-class income individual.

As a result, absent Windfall Elimination Provision, senior level government employees who spend most of their career not contributing to Social Security, while also earning a high salary and a government pension, would receive a generous Social Security benefit by working as few as ten years covered by Social Security.

The Social Security formula treats those ten years as if this was their only income during their working life, and therefore provides an unfair bonus.

That’s simply not fair to the average private sector worker who spends their entire career paying Social Security taxes, earning similar or lower pay than the government workers, but receives less Social Security benefit per dollar paid in.

Finally, Grassley argued the bill is unfair to states like Iowa.

In Iowa, only 8 percent of government workers are not covered by Social Security. For some states, it’s fewer than 5 percent.

But, there happens to be a handful of states where 50 percent or more of their workers are exempt from Social Security and thus don’t pay into Social Security taxes.

For instance, the state of Massachusetts, it’s over 97 percent of their government employees.

Can you imagine that, liberal Massachusetts thinks their government employees are too good for Social Security???

It’s these states that will be the big winners under this bill.

Effectively, states like Iowa, where the vast majority of government employees are covered by Social Security, are being asked to subsidize the retirement of government workers in Massachusetts, California and Colorado. States that largely chose to opt out of Social Security.

When the Senate debated this bill late in the evening of December 20, Grassley and Ernst voted for a trio of Republican amendments that failed to pass. Senator Rand Paul of Kentucky offered an amendment “to provide for automatic continuing resolutions.” Senator Ted Cruz of Texas tried to change the windfall provision language. Senator Mike Crapo of Idaho sought to delay repealing the two provisions “until additional changes are made to offset any negative impacts on the actuarial balance of the Social Security Trust Funds.”

Iowa’s senators did vote against one Republican amendment: Paul’s proposal to raise the retirement age from 65 to 70. That one failed by 93 votes to 3; Mike Lee of Utah and Cynthia Lummis of Wyoming were the only other supporters.

I couldn’t find any news release, social media post, or other public statement explaining why Ernst opposed the Social Security Fairness Act. She and Grassley usually land on the same side of bills, so she presumably shared his assessment of the policy. I will update this post as needed with any comments from Ernst about the measure.

Don’t be surprised if Republican or Democratic opponents in Iowa’s 2026 Senate race fault Ernst for voting against a bill that helped some 10,000 retired Iowans, including former teachers, firefighters, and police officers.

Top photo: Screenshot from official video of Senator Chuck Grassley’s remarks on the Social Security Fairness Act during floor debate on December 20, 2024.