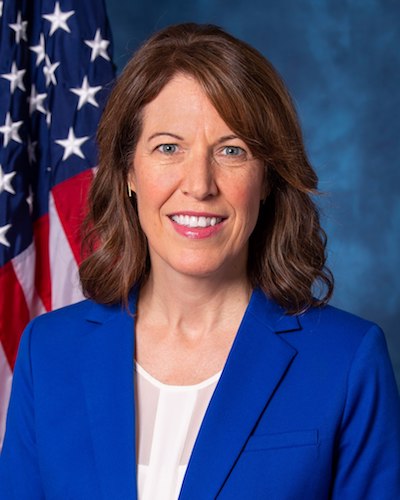

U.S. Representative Cindy Axne (IA-03) has corrected errors and omissions on the annual financial disclosure statements required for members of Congress, her office announced on October 8. The non-profit watchdog group Campaign Legal Center filed complaints last month against Axne and six other House members, saying they had not reported stock trades within the time frame specified by federal law.

Axne’s amended disclosures have not yet been posted on the official Congressional website, but I will update with the link when the files are available. UPDATE: Here are the revised reports for 2018, 2019, and 2020.

A news release described the errors as “clerical issues,” which Axne was unaware of before the ethics complaint.

As soon as she learned of these issues, she took steps to properly address them, including hiring an outside counsel to audit her reports and confirming with the third-party money manager who oversees the related retirement accounts that she did not personally direct or execute any of these trades.

Axne appears to have wrongly believed she was only required to report stock sales or purchases that she personally directed. The 2012 STOCK Act draws no distinction between trades executed by a member of Congress or investment advisers; all must be disclosed within 45 days, if the assets are valued at more than $1,000.

That said, a disclosure violation grounded in a misunderstanding about the law is less worrisome than a deliberate effort to conceal trades prompted by inside information.

Axne’s office said she has “filed the appropriate periodic transaction report and amendments to her previously filed reports to rectify the situation” and “taken steps to ensure these issues don’t happen again.”

Staff for Representative Mariannette Miller-Meeks (IA-02) have not announced whether she has amended her annual financial disclosure in any way. Bleeding Heartland discussed possible undisclosed assets and other omissions here.