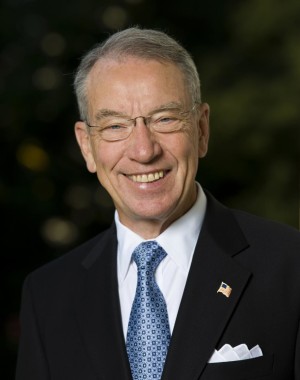

Despite being the most senior member of the U.S. Senate Finance Committee, Iowa’s Senator Chuck Grassley is not among the Congressional Republicans who will hash out a final tax bill. The Senate voted on December 6 to go to conference with House members, but Grassley revealed on Twitter this morning that he “was dropped” as a conferee.

Presumably GOP leaders want to distance themselves from Grassley’s recent comment that repealing the estate tax would reward “the people that are investing […] as opposed to those that are just spending every darn penny they have, whether it’s on booze or women or movies.” Those remarks have received massive nationwide media coverage, mockery, and condemnation.

Some Republicans had hoped the House would quickly send the Senate’s tax bill to President Donald Trump. However, in their unprecedented haste to rewrite massive legislation after an unfavorable report from the Joint Committee on Taxation, key GOP senators introduced errors in the bill approved over the weekend.

Notably, revised language on the corporate alternative minimum tax would increase taxes on many companies, sending business interests into “revolt.” Lily Batchelder, a law professor and former chief tax counsel for the Senate Finance Committee explained that issue in a series of tweets I’ve posted after the jump, along with a chart highlighting the key differences between the tax bills House and Senate Republicans have already passed. Other sloppily-drafted provisions “could be easily gamed” or “could open broad avenues for tax avoidance,” according to tax experts quoted by Politico’s Brian Faler.

Both bills would provide generous tax breaks to wealthy individuals while raising taxes on tens of millions of lower and middle-income households.

House Republican leaders have signaled they will agree to repeal the individual mandate to purchase health insurance, which was part of the Senate bill. By 2025, that provision would reduce the number of people with health insurance coverage by an estimated 13 million nationwide and by 125,600 in Iowa.

Appears corporate AMT provision probably raises >$300B, not $40B JCT estimated under duress Fri night. This means Rs have to take Senate bill to conference and can’t just have House pass it, unless they want to *really* piss off bus community. 1/5

— Lily Batchelder (@lilybatch) December 6, 2017

I’m getting >$300B from fact that provision appears to repeal R&D credit, which costs ~$113B, and participation exemption, which costs $216B. See JCT estimates at https://t.co/odhMFYTc68 and https://t.co/dcffBY0NKb. 2/5

— Lily Batchelder (@lilybatch) December 6, 2017

And corporate AMT provision does a lot more than this, so even $300B is probably low-balling. 3/5

— Lily Batchelder (@lilybatch) December 6, 2017

Before corp AMT amendment, Senate bill raised taxes on individuals by $82B and cut taxes on business by $48B in 2027. After amendment, could conceivably raise taxes on both, incl. US MNEs and manufacturers, though need revised JCT estimates to know for sure. 4/5

— Lily Batchelder (@lilybatch) December 6, 2017

Fact that Rs have to go to conference constrains their options, especially if Collins, Flake or others have second thoughts after seeing more evidence that commitments they received (e.g., Alexander-Murray, DACA) are not going to be honored. 5/5

— Lily Batchelder (@lilybatch) December 6, 2017

CNBC created this chart showing the most important differences between the House and Senate tax bills: