The Apple corporation’s plan to build a “state-of-the-art data center” in Waukee is attracting national attention and ridicule for a state and local incentives package worth more than $4 million to the country’s most profitable company for every long-term job created.

While Governor Kim Reynolds celebrated yet another deal to fleece taxpayers, one encouraging sign emerged last week: more Iowa politicians are willing to say out loud that this approach to economic development doesn’t pay for itself.

ANATOMY OF A RIPOFF

The Iowa Economic Development Authority and the city of Waukee refused to release details about the deal with Apple until shortly before the authority’s board rubber-stamped $20 million in state tax incentives, plus about $194 million from the suburb west of Des Moines. In return, Apple has promised its $1.375 billion data center will come online by 2020, with 50 full-time employees earning at least $29.12 per hour. The Des Moines Register’s editorial board observed on August 25,

As is typical, the taxpayer had no chance to weigh in before the Apple deal was cooked.

News of the project broke Wednesday, but documents spelling out the amount of incentives were released about 90 minutes before the state economic development board met Thursday. The meeting’s agenda included a 10-minute public comment period before approval.

The city of Waukee declined to provide the public any information before its council voted to give Apple more than $194 million in property tax abatement and water and sewer infrastructure improvements.

Shouldn’t residents have a say in a proposal that will affect city revenues for at least the next 20 years? “This isn’t our project,” said Waukee Mayor Bill Peard, who, like the rest of us, is just along for the ride.

The governor held a triumphant joint press availability with Apple Inc. CEO Tim Cook.

“This puts Iowa on the world stage,” Reynolds said. “This gives us an opportunity with a global company like Apple to say ‘we are the place to be, this is where your business should locate.'”

Asked if cash-strapped Iowa could afford to hand over that much in new tax breaks, Reynolds pointed to the optics of landing one of the world’s most ubiquitous companies.

“This is Apple,” she told reporters. “They chose Iowa.”

Pressed further, Reynolds said the tax breaks won’t come directly out of state coffers. “These are (tax) credits. It’s not a check,” she said.

Los Angeles Times columnist Michael Hiltzik dismantled the happy talk in a piece headlined, “Apple breaks new ground in squeezing locals for huge tax breaks while offering almost no jobs.” (The Des Moines Register later reprinted the column.) Noting that Reynolds and Waukee’s mayor “basked in the glory of sharing a podium with Apple CEO Tim Cook on Thursday,” Hiltzik wrote,

They should have hung their heads in shame instead. Apple took them to the cleaners, and their taxpayers will be paying the bill. The politicians talked as though the data center would put Waukee on the map as a first-class high-tech center. The truth is that it will mark Waukee as a first-class patsy. […]

That works out to $4.16 million per job. At prices like that, analysts at the subsidy-tracking think tank Good Jobs First have observed, “taxpayers will always lose.” That’s because there’s no way the new employees will pay that much more in state and local taxes than the public services they and their dependents consume. […]

Apple described the center in a press release as “state of the art,” but in today’s digital world that’s code for “robotic.” That’s why, after employing 500 construction workers for two years to build the place, Apple will need only 50 humans on-site to run it. Apple described the arrangement cleverly, stating it will “create over 550 construction and operations jobs,” without specifying how this big number would be broken down.

Here’s the full October 2016 report by Good Jobs First called, “Money Lost to the Cloud: How Data Centers Benefit from State and Local Government Subsidies.”

Iowa State University economist Dave Swenson has long railed against Iowa’s “witless and expensive obsession with capital investment.” From a commentary for this blog in 2015:

Here’s how these giveaways work: Firms are relieved of their state government and, almost always, large fractions of their property tax obligations in the future. The subsidies can last from few years to up to 20 years in the case of property tax rebates. Though relieved of most of their state and local taxes, the firms and their employees still demand and receive public goods. They use the roads, their children go to public schools, and they consume a normal bundle of public services just like every other business and household. But the subsidized businesses get a pass on helping to pay for it all. That means that the increments in demand for public goods are paid in large part by the rest of Iowa, nearly all of whom are not benefitting directly or indirectly from the development.

It must be obvious to all but the most willfully ignorant that these large tax credit deals of late – Orascom, Kum & Go, Facebook, Microsoft, Google – will not pay back Iowa taxpayers’ generosity. Ever. There is no magical fiscal multiplier effect to offset these indefensible public funds giveaways. Over time they serve solely to enhance the bottom lines of prominent, already successful, and immensely profitable firms, while the rest of Iowa bears the burden of paying incrementally higher shares of the taxes or fees for state and local government services that benefit us all, including the subsidized firms and their employees.

It is a completely unsustainable system, and it represents a classic “race to the bottom” where tax costs are shifted away from the benefitted businesses onto households and other existing businesses.

Amid last summer’s news about a Microsoft project in West Des Moines, Swenson specifically addressed the trend of providing large incentives for data centers.

Iowa like nearly every other state keyed into the growth prospects of data centers and passed legislation a few years ago exempting computers, technical equipment, and cooling systems from state sales and use taxes. As these centers are equipment dense, the exemption lowers their equipment costs from five to seven percent, depending on the state. When you add other incentives like state corporate and local property tax breaks, the amounts of assistance received by some of the wealthiest and most profitable companies in the world are substantial. […]

But Microsoft has or will invest a total of $4.6 billion in the Iowa economy. That’s something, right? You’d think so, but once you parse the spending, just how worthwhile is it? The land was already here. They just bought it. Next, though the new facilities are chock full of the latest and most sophisticated technology in the world, nearly all of it was not manufactured in Iowa or purchased from Iowa vendors. This is their biggest capital cost, but almost zero Iowa economic impact there. Lastly, they will build a facility to house all of this wonderful technology, which will eventually go on the property tax rolls (computing equipment is not taxed), but that is really the least of their major costs. In short, they are erecting a great big box to house oodles of high tech gadgets that are made somewhere else. It is, at best, a highly automated turnkey operation that employs relatively few people – the labor income yield for Iowa is, in light of the gross annual receipts associated with the facility, negligible.

Once up and running, data centers have very lean connections to the rest of Iowa’s economy, as well. Yes, they will buy gargantuan amounts of electricity, but they will require precious little else. They will neither tap into nor stimulate technology sectors in the state. They are big, remote, and super-secure hot boxes that have, literally, hardly anything to do with the rest of Iowa. To pretend otherwise is silly.

These firms are here because land is comparatively cheap, energy is plentiful and inexpensive (a goodly fraction of which is wind-powered, which allows for greenstanding opportunities), and there are few environmental or civil risks in a place like Iowa. Further, medium sized metropolitan areas are attractive from a staffing standpoint, major airport access, and because of quality of life opportunities.

In short, the Des Moines metro was, is, and always will be in the running for a data center, all incentives aside.

Yet we seek them, subsidize them, and economic development leaders point to them as evidence of emerging tech sector prominence. It’s an illusion.

Responding to cheerleaders for the new deal with Apple, Swenson commented on Twitter that those who say companies would not come to Iowa without subsidies are missing the point. Government support of the private sector should focus on addressing “market failures — instances where the market does work to the betterment of society at large.” But “Subsidizing businesses on the fringe of a booming metro where unemployment rates are low is not addressing a market failure.” On the contrary, “governments are shifting public costs to unsubsidized firms and households in the name of economic development,” which is a “private good that is producing private benefits, not public benefits.” Taxpayers don’t get their money’s worth “because the sum of all tax collections net of the public goods they consume aren’t sufficient to pay back the original subsidy.”

UPDATE: Hiltzik interviewed Swenson for a follow-up column, which argued that the package for Apple “looks even worse.”

“Firms know where they want to be,” says economist David Swenson of Iowa State University. “The question of how much in rents they can extract from state and local governments is phase two. But taxes are a secondary consideration.” […]

Some elements of the package are still shrouded in mystery.

But at least one major element of the original announcement has proven to be extremely misleading. That’s Apple’s contribution of “up to $100 million” to an infrastructure fund for Waukee. As it turns out, “up to” was an important but overlooked phrase. That’s because the total contribution would be dependent on expansion of the data center well beyond the 400,000 square feet originally announced. Unless that expansion occurs, Apple’s contribution will be only $20 million, a source close to the deal told me. In other words, Apple is guaranteed to contribute only one-fifth as much as people were led to believe.

Reynolds continued to defend the deal at an August 29 press conference.

“I think it solidifies that Iowa is a tech and innovation hub,” Reynolds says. “This is about jobs and this is about infrastructure and this is about growing the economy.” Apple estimates 50 people will work at the two data centers in Waukee once they’re built. […]

“It’s not just a snapshot in time,” Reynolds says. “You’ve got to look long term and see the benefits that will continue to grow and if you look at Google and if you look at Facebook and if you look at other areas across the state where you’ve seen this kind of investment and the build-out in infrastructure, I think it demonstrates that, really, the long-term growth in jobs is phenomenal.”

A few years ago, similar comments from Iowa’s governor would have gone unchallenged. No longer.

NEAR-CONSENSUS AMONG IOWA DEMOCRATS

Democrats controlled both chambers of the Iowa legislature and the governor’s office when a 2007 law made data center projects eligible for certain state tax credits. Then Iowa Senate Majority Leader Mike Gronstal, who represented Council Bluffs, “helped tweak the state’s rules on economic incentives to help lure Google” to the city. According to a 2014 report by the Iowa Economic Development Authority, Google was the first company to get Iowa tax credits for a data farm.

The same report showed that through 2014, Iowa data farm projects received more than $77.7 million in state tax benefits, creating an estimated 332 permanent jobs. That works out to more than $234,000 per job from the state alone. Most of the companies also received huge breaks from local government in property tax abatements and sewer or road improvements.

The initial package for Google provided about $1.4 million in state tax incentives, in exchange for creating 60 permanent jobs at an hourly wage of at least $25.02.

A 2012 deal involved $16.8 million in state tax incentives for Google to expand its Council Bluffs facility, creating just 35 long-term jobs at a wage of at least $18.81. That works out to about $480,000 per job in state tax benefits alone, but political criticism was muted. Gronstal joined the mayor, then Governor Terry Branstad, and Lieutenant Governor Reynolds at a press conference.

“Google’s decision to build in Iowa, and its continued invest-ment are a clear example of a successful local, state and private partnership,” Gronstal added. “Working together, we’ve built a framework for success that bene-fits the people of Council Bluffs and Carter Lake, private industry and the state of Iowa. Google has been a great corporate citizen because of its support for local schools, small businesses and nonprofit organizations.”

Facebook got an even bigger handout in 2013: $18 million in state tax credits and a 100 percent, 20-year property tax abatement from the city of Altoona. Under terms negotiated by the Iowa Economic Development Authority, Facebook’s parent company promised to create 31 long-term jobs at the data center, paying at least $23.12 per hour. That’s more than $580,000 per job in state tax benefits alone.

When Facebook’s first Iowa building was completed in November 2014, the Des Moines Register’s story by Matthew Patane didn’t quote any politicians questioning the cost or the return on taxpayers’ investment.

Lt. Gov. Kim Reynolds said Facebook’s project is a “great marketing tool” for the state.

“As we maintain our strong focus on attracting high-quality jobs for Iowans, having Facebook locate in our state has been a huge win,” Reynolds said.

Debi Durham, director of the Iowa Economic Development Authority, said the company has helped put Iowa on the map.

“It wouldn’t be an understatement to say that the existence of Facebook was a disruptive force to the very way society communicates. … Facebook, you’ve done it again, your presence is a disruptive force to how the world views Iowa,” Durham said.

Local leaders lauded the company for its contributions to the community.

“It already is a great neighbor. Facebook is community minded and community involved,” Altoona Mayor Skip Conkling said. “The $75,000 (Facebook) has put into nonprofits around here since April of 2013, that’s just the beginning.”

Facebook’s local charitable giving doesn’t come close to matching the tens of millions it will avoid in property taxes. But won’t that money come to Altoona’s government eventually? Not necessarily, as Mike Rogoway wrote for The Oregonian in October 2015.

[The Dalles city council member Taner Elliot] worries that Google might keep its tax breaks indefinitely, regardless of what the original deals call for. He unsuccessfully sought to add a provision to the latest agreement that Google would not seek an extension of existing tax breaks, or to replace them with something similar.

“We’re willing to wait for our money,” he said, “but we want to be sure we have that money in hand.”

Prineville [Oregon] Mayor Bette Roppe has said she similarly expects Facebook’s data centers to come onto the tax rolls when their 15-year exemptions expire. The mayor of Altoona, Iowa, says he expects the same thing to happen with Facebook’s tax breaks there.

It may all be wishful thinking.

In each case, it may be hard to imagine data center operators accepting significantly higher operating costs for aging facilities when they could build a brand-new server farm somewhere else without the taxes.

Facebook is constructing a third and fourth building in Altoona and employs about 200 people full-time at the facility.

Meanwhile, Microsoft has received four different incentives packages for data centers in West Des Moines. The first two (in 2008 and 2011) were for less than a million dollars each in state tax credits, but the Iowa Economic Development Authority later approved much larger packages. Microsoft promised to create 29 long-term jobs at $23.12 an hour for $20 million in state tax benefits in 2013. The following year, the corporation received another $20.256 million for creating an additional 84 jobs paying at least $24.32.

Iowa’s taxpayers will not see a good return on these public investments. Swenson concluded last year, “Iowa’s heavily subsidized and sought-after data centers provide so-so pay to a comparative handful of mid-tech workers. The Iowa economy hardly notices the growth, the state subsidies never gets paid back in the form of net new state tax collections, and when all is said and done, the flow of benefits is decidedly one-sided — out of Iowa, that is.”

Few Democratic elected officials faulted Iowa’s earlier deals for data centers, but many spoke out against the agreement with Apple, linking corporate tax giveaways with state revenue shortfalls that have led to painful cuts in education, human services, and public safety.

All seven Democratic candidates for governor have criticized the deal with Apple in written comments, speeches, or social media posts. State Senator Nate Boulton said in a statement,

“While I’m pleased to see good-paying jobs come to Iowa, handing out a $213 million combined tax coupon to the world’s most profitable company to create 50 unspecified jobs raises some concerns that this administration is stuck in its ways of handing out excessive corporate tax credits to the detriment of other essential Iowa services and a sound budget […] We are talking about a company worth $750 billion, a company that doesn’t need to siphon away $20 million in future state funds at a time when this administration is using millions of emergency funds to plug holes in our current budget. […]

While partnerships between companies and communities are essential to economic development, the partnership must benefit both parties equally, and I am disappointed not to have seen any guarantee from the administration or Apple that Iowa’s skilled workforce will be used to construct this facility.”

From Fred Hubbell, who has an extensive business background:

“Iowa has a serious budget mess – a mess created by politicians that have a habit of prioritizing wasteful corporate giveaways over healthcare, education, and raising incomes around the state.

“When I led the Iowa Department of Economic Development, my top priority was to hold corporations’ feet to the fire and make sure Iowa’s taxpayers got a good deal, but in this case it appears that taxpayers are paying $400,000 per job. Take it from me: this is a better deal for Apple than it is for Iowa’s taxpayers. Iowa’s taxpayers deserve better than this from their Governor.”

As a guest on ABC-5’s Sunday morning program “This Week in Iowa,” Hubbell said,

It’s great that the Googles and Microsofts, Facebooks and Apple, want to be in Iowa, but frankly, they’re negotiating a much better deal than we are. We’re giving way too much money to bring big names to our state because the names sound and look good, and we’re not getting very many jobs.

“When you think about it, there are more Apple jobs in the store in Jordan Creek Mall than there are at this plant, and we’re giving them $20 million, but we didn’t give them any money for the store.

Hubbell again faulted the Apple package at the Poweshiek Democrats picnic in Grinnell on August 27, saying he served on a tax credit review panel for Governor Chet Culver, which recommended $161 million in tax credit eliminations in 2009.

At an Iowa Federation of Labor event on August 24, John Norris called on state leaders to “Invest in people and infrastructure and stop the handouts to a few corporations.” Norris brought a bag of apples to the Grinnell event, handing them out to symbolize state government’s giveaways. To the current administration, Norris charged, “Apple’s more important” than public services for vulnerable Iowans, like Medicaid and ombudsman visits to nursing homes.

Norris added in the same speech,

I’ve got nothing against Apple. I think it’s great that they’re here. […] I think it’s great that we attract businesses. […] But they have their responsibility to support government and people as well. And they should not be let off the hook for supporting education and health care and environment and our public infrastructure. This governor and this government is sending the wrong signal about what our expectations of government are.

Similarly, Andy McGuire talked to the Poweshiek Democrats about the Branstad/Reynolds legacy of putting “profits before people.” She had previously re-tweeted a Des Moines Register reporter’s link to Hiltzik’s “absolutely blistering column”:

Gubernatorial candidate Ross Wilburn told the Grinnell audience,

As a mayor of Iowa City, we were very judicious about the tax breaks that we gave. We wanted to know, what can we receive from corporations […] The tax breaks that we gave, they tended to be short-term. The Plaza Towers in downtown Iowa City, it was seven to eight years long. And after those seven to eight years, a million dollars a year came in for schools, for the county and for the city. Those are the types of decisions that we need to make.

Soon after news of the Apple deal broke, Jon Neiderbach posted on Facebook, “Iowa taxpayers are now being asked to subsidize Apple, one of the largest corporations on the planet? NO WAY!” During his August 27 speech in Grinnell, he spoke more broadly about a “rigged system,” where Iowa’s surplus money “was spent on tax breaks for the rich. It was spent on huge commercial property tax cuts. […] That’s where the money is going, and quite honestly, Democrats have not stood up as strongly as we should have against those things.”

Cathy Glasson shared the link to Hiltzik’s column with her Facebook followers and re-tweeted other like-minded comments.

Numerous Democratic lawmakers used their Facebook accounts to bash the giveaway to Apple or share the link to Hiltzik’s Los Angeles Times piece.

In an interview with Bleeding Heartland, the newest Iowa House Democrat Phil Miller alluded to the Apple deal as he lamented cuts to K-12 education: “we need to take care of our children before we take care of real large, profitable companies.” He questioned why Iowa can afford large incentives for Apple when budget cuts have eliminated on-site nursing home visits by ombudsmen. Miller represents a competitive House district covering small towns and rural areas, not a safe Democratic seat.

State Senator Jeff Danielson, who stakes out more moderate stands on some issues, welcomed news about the Facebook data center in Altoona a few years ago. He didn’t praise the Apple deal, though. In recent months, Danielson’s e-mail newsletters to supporters have called for “Re-examining tax breaks for big corporations,” among other policy changes.

Deidre DeJear, one of two Democrats running for Iowa secretary of state, commented on Twitter today,

Apple's creating 50 jobs in IA. What're we doing 4 our 260k smallbizs who provide 40% of IA jobs. https://t.co/bT4G79GWfD via @PB_News

— Deidre DeJear (@deidredejear) August 29, 2017

Whereas few Democrats spoke out against the state’s contracts with Google and Facebook, the blowback from Apple has shown that opposing such large giveaways to profitable corporations is becoming a consensus position for the party.

DOUBTS AMONG IOWA REPUBLICANS

Cedar Rapids Mayor Ron Corbett, who is seeking the Republican nomination for governor, has criticized the current administration as too beholden to special interests. So I wasn’t surprised when he told reporters today, “I don’t have all the specific details…but I would have required Apple to have more than 50 jobs” as a condition of the incentives package.

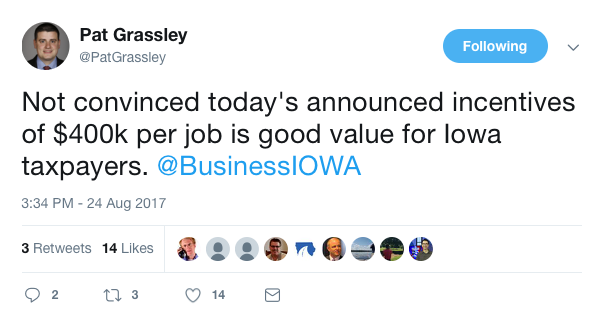

I expected the rest of Iowa GOP establishment to echo the Reynolds line. I was wrong. Iowa House Appropriations Committee Chair Pat Grassley tweeted on August 24,

Not convinced today's announced incentives of $400k per job is good value for Iowa taxpayers. @BusinessIOWA

— Pat Grassley (@PatGrassley) August 24, 2017

Grassley is widely seen as the front-runner to become Iowa secretary of agriculture after the incumbent Bill Northey resigns to take a federal government post. If Reynolds wasn’t already looking at other people she could appoint to replace Northey–perhaps Annette Sweeney?–she probably is now that Grassley has questioned what she touts as a major accomplishment.

After his tweet received a lot of attention, Grassley hedged his bets by calling for a “review of tax credits” and blaming Democrats (who currently hold no levers of power in Iowa) for not supporting tax reform.

1/2 ? to @IAGovernor continued success of bringing high quality jobs to IA is tax reform, which should start with review of tax credits

— Pat Grassley (@PatGrassley) August 25, 2017

2/2 This session zero @iahousedemocrat supported Republican efforts to reform in approps cmte look fwd to their support next time #ialegis

— Pat Grassley (@PatGrassley) August 25, 2017

Drew Klein, state director for the Koch-funded group Americans for Prosperity, lent support to Grassley’s position, adding that he is for bringing good jobs to Iowa, “but I would prefer we didn’t force taxpayers to help fund private companies and their investments.”

I ❤ bringing jobs to Iowa, but I would prefer we didn't force taxpayers to help fund private companies and their investments. #ialegis https://t.co/Hs5i4oSofd

— Drew Klein (@Klein_Drew) August 25, 2017

House Speaker Linda Upmeyer qualified her support for the Apple deal.

(2/3) Lots of discussion around the benefits of tax incentives lately. Iowa needs to be more competitive and fair for EVERYONE #ialegis https://t.co/dcqmNO8h8B

— Linda Upmeyer (@SpeakerUpmeyer) August 24, 2017

Upmeyer said in a follow-up tweet, “Incentives wouldn’t be as necessary but Iowa has the highest corporate tax rate in the USA. We need tax reform for all.”

The governor and her advisers appear to view the Apple data center as a winning issue for them in next year’s election. However, spinning criticism of corporate giveaways as an “anti-jobs position” may not resonate for Reynolds as it did for Branstad in 2014. The state budget is in shambles and at risk of deteriorating further just as voters are paying more attention to the governor’s race. Most Iowans don’t live in communities as prosperous as Waukee. But most important, a growing number of politicians in both parties acknowledge that taxpayers aren’t well served by large subsidies for profitable corporations.

1 Comment

Crisis/Opportunity

Dems looking to rekindle some sense of connection with rural Iowa may have been given a very powerful issue. Reynolds gave away (y)our tax money to the most profitable company in the world for….what?

Her giddiness in the presence of Apple’s CEO, while understandable, confirmed what I feared: Cook and Co. saw her coming and picked her (our) pockets like the world-class dealmakers that they are.

Oh well, Maybe Apple can outfit each Iowa nursing home and care facility with iPads and iChat so state ombudsmen can at least remotely check in with the clients they can’t afford to visit in person.

Sincere thanks for your reporting.

dbmarin Wed 30 Aug 10:03 PM