Austin Frerick, an Iowa native and economist who has worked at the Institute for Research on Poverty and the Congressional Research Service, follows up on the trend of Iowa state universities becoming “increasingly dependent on higher tuition and student fees to make up for the declining state support.” -promoted by desmoinesdem

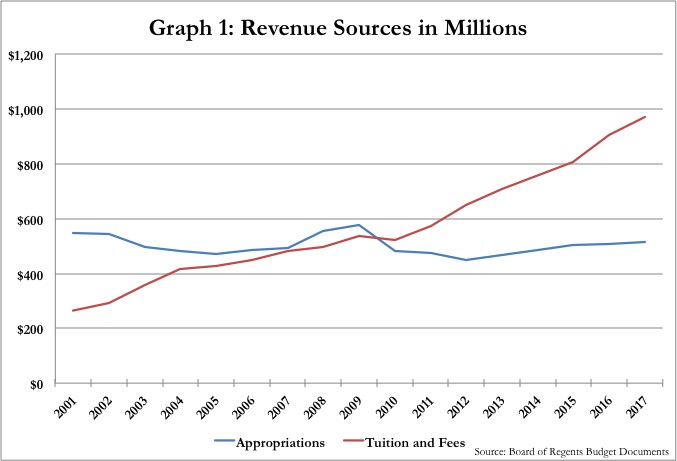

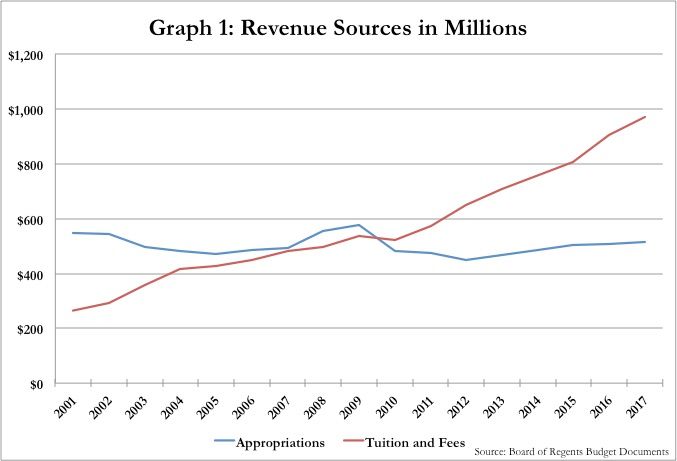

The Iowa Board of Regents recently approved another budget that does nothing to stem the privatization of higher education in Iowa. State appropriations in fiscal year 2017 for the University of Iowa, Iowa State University, and the University of Northern Iowa is still LESS than it was in 2001, down 32 percent when you adjust for inflation. And while investment falls, tuition and student debt continues to soar to record highs.

I updated the figures from a previous post on the subject and the trend lines have only intensified.

Graph 1 shows that the schools are becoming increasingly dependent on higher tuition and student fees to make up for the declining state support.

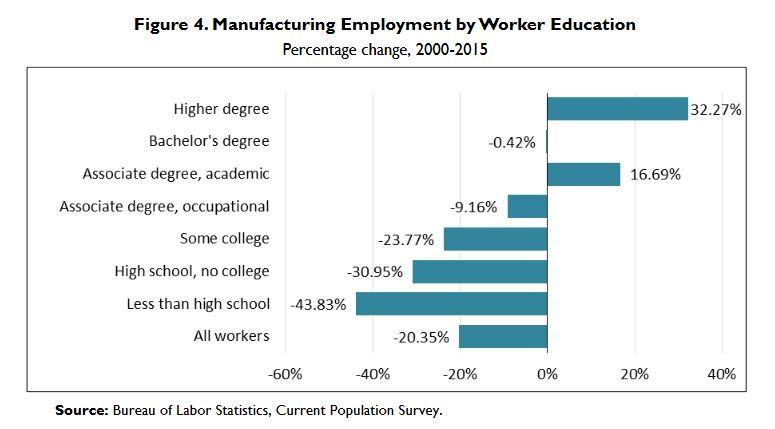

Compounding this problem is that almost all new jobs require some sort of post-high school education: even manufacturing jobs. According to a recent nonpartisan Congressional report, all the new manufacturing jobs since 2000 have required some sort of post-high school education, as seen in Graph 2. Given this reality, we should be doing the opposite of what we are doing now; we should double down on investment in education so that Iowans have the skillsets to get these jobs.

The problem with the gradual privatization of higher education is that the impacts aren’t really visible to the naked eye. Yet you see it in the UNI graduate from Fort Dodge who has to take a job in the Twin Cities, instead of a job in his hometown because the salaries are higher, and he has a lot of student debt. You see it in the single mom who wants to finish her bachelors to get that better job, but passes because she doesn’t want to take on the debt. Higher education privatization hinders access for individuals and Iowa’s economic growth. It’s like the Titanic: we’re slowly taking on water but at some point, the ship will no longer be able to bear it.

The updated data can be found here.

4 Comments

What about...

inflation adjustment on the Tuition and Fees?

Or, quite honestly, the most telling figure, which is Total Revenue for the Regents institutions, fast approaching $1.5B. This is up 82.5% in the last 16 years from $813M in 2001.

Inflation-adjusted, Total Revenue is up 34%.

One might ask why the total revenue of the institutions keeps climbing, because THAT out-pacing is frankly more worrisome than whether or not the income is from appropriations or tuition.

Free Money from the Fed seems to be a big part of it. After all, why keep tuition in check when a FAFSA takes almost no time to fill out, and can net almost the entire balance due each year?

cr_citizen Thu 28 Jul 4:35 PM

Perhaps

Very good point cr_citizen. My gut is that these cost are coming from these schools engaging in building costly status seek amenities to increase their recruitment of out-of-state students like building restaurants in dorms, $50+m gyms, etc.

arfrerick Tue 2 Aug 6:45 PM

too much missing

Okay, before we get to any other revenue sources, the obvious question is: where’s it all going? You’re looking at a budget of about $700M in 2002 v. a budget of $1.4B in 2017. Where has the money gone?

Second, what about all the other revenue sources? I mean:

Total grant revenues, including indirect costs

Gifts received (rather than pledged)

Investment returns

Net of athletics

Hospital net

IP revenues

Bond sale proceeds

Merchandise sales (bookstore net)

Any net on dormitory/meal-plan revenues

So?

dormouse Fri 29 Jul 12:56 AM

Grant.

I’d love a grant dormouse to dig into the issue! That’s a very good question. Newspaper used to do that, but now it’s left to full time workers researching it on the side to do it….

arfrerick Tue 2 Aug 6:48 PM