Many thanks to Austin Frerick for this close look at the hidden costs of choices by elected officials. Frerick is an Iowa native and economist who has worked at the Institute for Research on Poverty and the Congressional Research Service. -promoted by desmoinesdem

In the coming weeks, thousands of Iowa families will sit down for painstaking hours to fill out the Free Application for Federal Student Aid (FAFSA). They do so in order to see if they qualify for college financial assistance. What makes it painstaking? After completing countless online forms detailing a family’s financial circumstances, a family is told what its costs for college will be with very little explanation for how this number is determined.

Over the past 15 years, Iowa has radically altered its higher education system from one that invests in its citizens to one which forces students to take on excessive debts while recruiting wealthy students from out of state. FAFSA has been the key instrument in creating this current predicament. The process was never meant to be this way. The story of the privatization of higher education and reliance on FAFSA is a story of neglect and bureaucratic inertia.

Iowa’s Declining Support for Higher Education

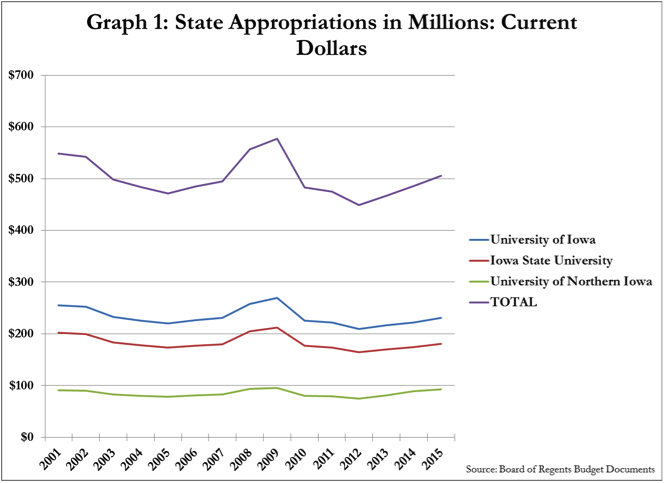

Looking solely at number of dollars we can see in Graph 1 how funding in higher education has yet to fully return to its pre-Great Recession levels. For that matter, it has yet to return to the level of funding experienced before the 2001 Dot.com recession.

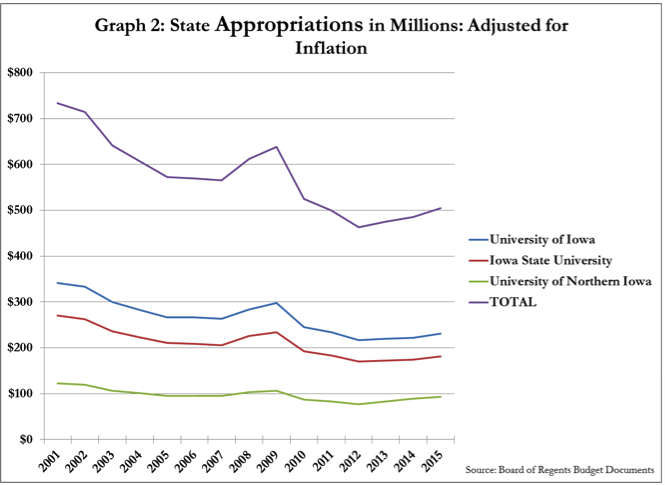

Graph 2 shows that the situation becomes even bleaker when looking at data adjusted for inflation. The state legislature needed to allocate an additional $229 million just to equal what it gave 15 years ago.

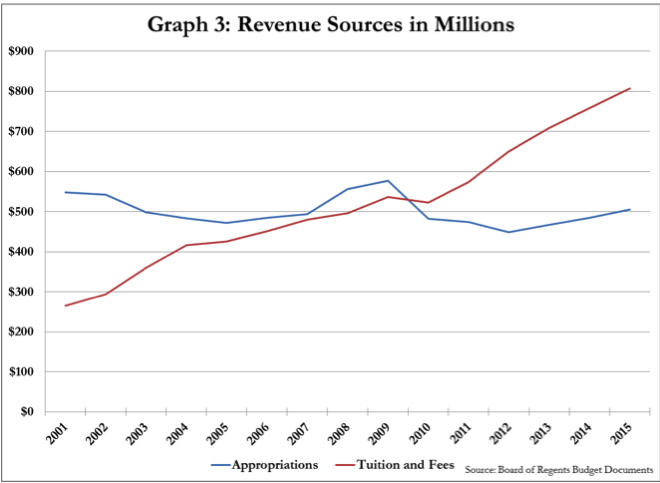

In response to the decline in state support, Iowa universities have increasingly turned towards tuition and fees to make up the difference (see Graph 3). Revenue from tuition and fees has nearly tripled in 15 years to $810 million. These dollars are obtained by charging Iowa families more, and by increasing the number of out of state students who pay significantly higher tuition rates. FAFSA is the mechanism used to capture these dollars.

Maximizing Tuition from the Free Application for Federal Student Aid (FAFSA)

The creation of what we now know as the FAFSA occurred as a result of The Higher Education Amendments of 1992 (P.L. 102-325). With these amendments, Congress mandated the creation of a single, free federal form to determine financial aid packages (previously there were multiple federal forms and not all were free.) Unfortunately, as state governments, including Iowa’s, have decreased their investments in higher education, schools have increasingly used FAFSA as an excuse to leverage more and more out of families.

Compounding the haze around the cost of college is a less familiar phenomenon called tuition discounting. The College Board defines tuition discounting as “charging different students different prices for the same educational opportunities.” That is, a college or university marks up the sticker price just so their financial aid office can then mark it down based on what they think a family can pay. The actual price each student is charged then can be all over the board. The catch here is that no one knows what anyone else has to pay. However, this process of tuition discounting is impossible without the financial information provided in the FAFSA as its the instrument used by schools to leverage more and more out of families.

For example, Grinnell College’s advertised comprehensive cost in 2013 was $60,738 and its discount rate that year was 62%. This discount rate meant a family would pay $23,080, on average, to attend, but this figure masked a significant variation in what families actually paid. Some families paid nothing while others paid the full-advertised price. Unfortunately, I cannot write about this phenomenon as it pertains to the major Iowa public institutions, because none of them (Iowa, ISU, or UNI) publish their tuition discount rate.

Setting judgment aside, if you want to run schools like a business, then this system is efficient and profitable. To prospective students, a high sticker price may convey a sense of quality and exclusivity. At the same time, students feel wanted and special when they are offered an institutional grant or a “merit scholarship” to a school with a high sticker price. In most instances though, but not always, financial assistance awarded by the schools themselves like merit scholarships, grants, institutional aid, etc. are nothing more than the school adjusting its price to get the most out of a family.

Unfortunately, tuition discounting can scare off a substantial number of qualified low-income, students because they do not realize that the sticker price is meaningless. Additionally, according to a recent New America study, financial aid packages aren’t enough for lower-income families. The study found, “almost 90% of families earning less than $30,000 per year are required to pay more for college than their official expected contribution, compared with only 37% of families making more than $110,000.” Consequently, for too many vulnerable families paying for college has become a precarious obstacle to financial stability, rather than a pathway to opportunity used by past generations of students to move ahead.

Chasing the Dollars: More Out of State Students, Fewer Iowans

In response to these severe budget cuts, Iowa and ISU have significantly increased their recruitment of out-of-state students. Another recent New America study found that “state disinvestment and institutional status-seeking have worked together, hand-in-hand, to encourage public institutions to use their institutional aid dollars strategically in order to lure affluent students to their campuses in order to climb up the rankings and increase their revenue.” These various status-seeking amenities, in turn, drive up the cost for everyone.

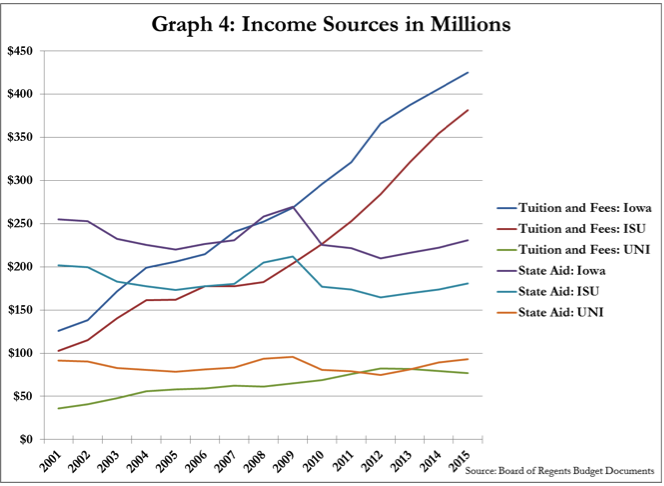

As you can see in Graph 4, Iowa and ISU have had massive success in out of state recruitment. As a result of these efforts, revenue from tuition and fees has soared since 2008. And the FAFSA has allowed them to squeeze the most out of these families.

But success with this funding strategy isn’t uniform across the state. UNI has not had much success with this new norm of financing higher education with tuition and fees compared with its counterparts. Compounding this problem is the fact that UNI educates the greatest proportion of Iowans: 88%. Tragically, the state university that educates the greatest percentage of Iowans is facing the worst of the fallout from the state’s failure to invest in public higher education.

Future of Iowa Higher Education

Unless things fundamentally change in the near future, the state of higher education in Iowa looks grim. Using recent history as an indicator for the future: State-funding for UNI, Iowa, and ISU will remain flat. Then, at some point when the next economic downturn occurs, funding will likely fall to a new low, lower than any time since the release of the first Harry Potter film. At the same time, Iowa and ISU will likely educate fewer Iowans in total, as out-of-state students become an ever more profitable and thus alluring. While the Regents have attempted to correct this perverse incentive structure by tying state aid to the number of Iowans educated at the institution, the core problem still exists: the decrease in investment and the growing privatization of our public universities. Solutions that do not address this fundamental problem will not be able to get to the heart of the problem.

Date Notes: “State appropriations” refers only to state funds that provide support for the educational function of the universities. These totals do not include state funds for specific things like agricultural initiatives, athletic programs, economic development initiatives, health care initiatives, veterinarian initiatives, etc.

Funding Data can be found here.

APRIL 23 UPDATE: In this weekend’s Des Moines Register, I proposed a solution to this problem. Let me know what you think. My goal is to start a needed conversation.

Austin Frerick is an Iowa native and an economist in Washington, D.C. He formerly worked at the Institute for Research on Poverty and the Congressional Research Service. Contact: arfrerick@gmail.com or @afrerick on Twitter

1 Comment

a deeply personal experience

As a native Iowan, I also realized, only in retrospect, that I paid the same amount in tuition as several peers that chose to attend one of the expensive and prestigious private colleges described in your article. Steady decreases in funding likely contributed to this phenomenon. My high school counselors, my parents, my teachers, and my peers had no understanding of the impact of tuition discounting on the overall price of attending college. I look back and realize that I might have attended a prestigious private college as a native Iowan, for instance, and paid only a fraction of what I paid at a state university for what would have very likely been a superior educational experience. I wish that more prospective Iowan students were aware of the fact that private institutions almost always have the resources available to significantly discount a student’s tuition. I also hope that your knowledge of this system can help spread awareness and work to combat the underlying issues at hand. An increase in state-aid for Iowa’s state universities is desperately needed, especially in light of the current upward trend in tuition fees across the board. Please consider publishing in local newspapers if you have not already, as this is a topic many Iowans should strongly consider in the next election cycle.

peachwine Tue 19 Apr 11:07 AM