The more things change, the more they stay the same.

Leaders in the Democratic-controlled Iowa Senate agreed early in the 2015 legislative session to pass two major tax bills backed by top Iowa House Republicans. The moves left Democrats no leverage to obtain concessions from Republicans on state spending for vital services, especially education. After months of negotiations, the final deal struck after Memorial Day gave House Republicans what they wanted on global budget targets and acceded to their demand for “allowable growth” of only 1.25 percent for K-12 education budgets.

As a gesture toward compromise, Republicans agreed last year to a supplemental spending bill, which included one-time funding for K-12 school districts, community colleges, and state universities. But once lawmakers had adjourned, Governor Terry Branstad item-vetoed some $56 million for education from that bill. The governor pleaded fiscal responsibility in his veto message, though such concerns hadn’t stopped him from signing $99 million in tax cuts into law months earlier.

I had high hopes for a better outcome this year when I saw Senate Democrats balk at passing a $97.6 million “tax coupling” bill much like the one that sailed through the upper chamber in 2015.

But during the past two weeks, Democrats approved harmonizing the state and federal tax codes as part of compromise legislation that was not linked to education spending. Then they agreed to school funding levels very close to the House Republicans’ initial offer for fiscal year 2017, which begins on July 1 and runs through next June. Lower projected state revenues forced Democrats to accept insufficient allowable growth for K-12 school budgets, lawmakers told disappointed students and educators. As usual, budget constraints never seem to be a reason for the Iowa legislature to say no to constituencies seeking expensive tax breaks.

BACKGROUND

Just like last year, a key reason lawmakers were unable to agree on adequate school funding was the huge commercial property tax cut lawmakers approved near the end of the 2013 legislative session. A Legislative Services Agency analysis of Branstad’s proposed budget for fiscal year 2017 explained in January,

Three other areas making up a substantial part of the General Fund budget include Higher Education (Regents and Community Colleges), the Department of Corrections, and Property Tax Replacement appropriations. Together, these three budget areas comprise approximately 22.0% of annual General Fund appropriations.

Of these three areas, the appropriations for property tax replacement will be experiencing the greatest growth in FY 2016 and FY 2017 largely due to the enactment of SF 295 (Commercial Property Tax Act) in 2013. The legislation phases in reductions to Iowa’s commercial and industrial property taxes over a four-year period (FY 2015 – FY 2018) and created two standing appropriations designed to reimburse local governments for the reduced property tax revenue. The combined amount appropriated for the commercial and industrial property tax replacement in FY 2015 and the Business Property Tax Credit totaled $137.7 million. These appropriations are estimated to grow to $252.6 million in FY 2016 and $279.6 million in FY 2017.

In other words, the 2013 commercial property tax cut took about $280 million off the table for next year’s budget. That amount of money could have covered more than 5 percent allowable growth for K-12 school districts.

Compounding the problem, state lawmakers have approved various expensive tax breaks over the years, reducing available funds for education or other services. Peter Fisher explained Iowa’s “largely self-inflicted” revenue shortfall for the Iowa Fiscal Partnership in January. The whole piece is worth reading, but here’s an excerpt:

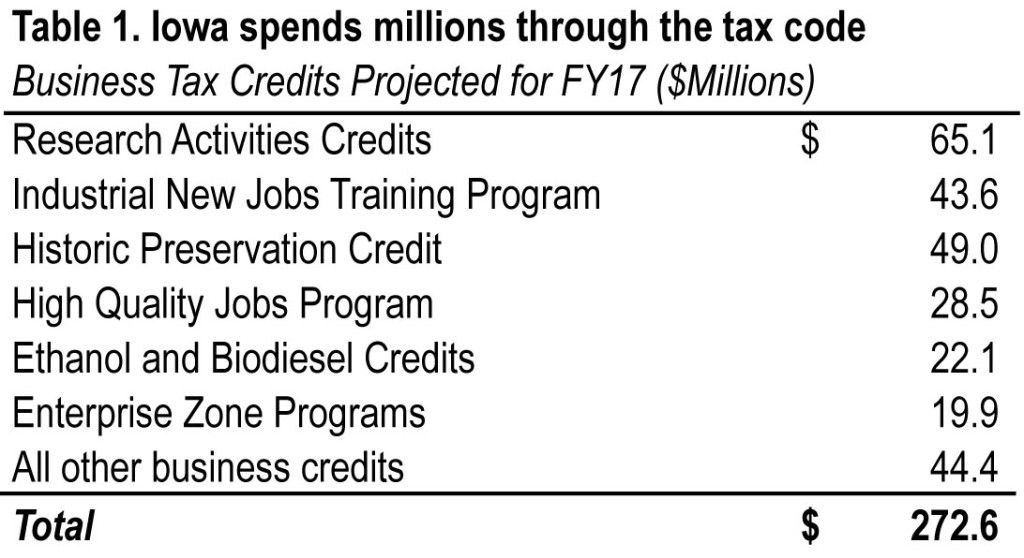

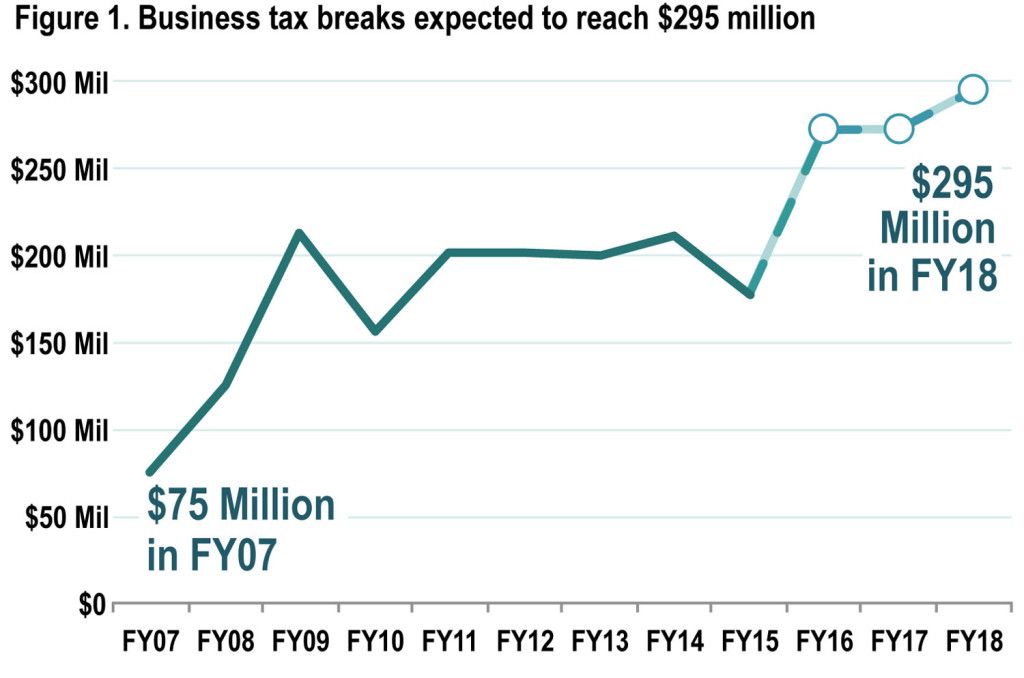

Why is revenue growth a problem in a state that has done better than most in recovering from the Great Recession? The answers can be found in the growth in business tax breaks. Business tax credits already on the books drained $178 million from the state treasury in fiscal year 2015, then grew by $94 million to $272 million in FY16, and are expected to remain at about that level next year. The six largest credits (or groups of credits) account for 84 percent of the total (Table 1).

State law restricts spending to 99 percent of projected revenues, determined by a Revenue Estimating Conference that meets three times a year. Its December meeting slightly lowered revenue projections for the 2017 fiscal year. As this year’s legislative session began, Branstad staffers and top legislators warned that the state budget would be “tight.”

THE LANDSCAPE ON TAX BREAKS

Legislative leaders from both parties acknowledged in December that because of slow growth in state revenues, the Iowa House and Senate were unlikely to approve large new tax cuts this year. Nevertheless, House Republicans supported two costly tax proposals: a “coupling” bill that would harmonize several aspects of Iowa’s tax code with federal law, and a new sales tax break for manufacturers that the Branstad administration had enacted through administrative rule making. Late last year, Republicans frustrated Democratic attempts to block the administrative rule and signaled that they would not support Democratic efforts to nullify it through legislation. Bleeding Heartland told that story in more detail here.

The governor’s proposed budget for 2017 did not include making tax coupling retroactive to the 2015 tax year, which was expected to cost nearly $100 million. Branstad explained that doing so would “basically wipe out the opportunity or dramatically reduce our ability to provide additional funding” for schools.

On the other hand, Branstad defended the new sales tax break as a necessary economic boost, even though Iowa’s manufacturers already “enjoy a particularly privileged position compared to other commerce in the state and to other manufacturers nationally,” Iowa State University economist Dave Swenson has shown. The cost of the sales tax break was hard to gauge, but as Jon Muller explained in a must-read backgrounder, it was clearly “an ongoing tax cut of increasing value.”

House Republicans moved this year’s tax coupling bill early, hoping to get it signed into law before Iowans had to file their 2015 tax returns. The fiscal note on House File 2092 indicated that the bill would reduce state revenues by $97.6 million.

Of the newly-permanent provisions, the most significant from a fiscal impact perspective is the extension and enhancement of favorable depreciation accounting known as “Section 179 expensing.” This provision allows business taxpayers (including corporate taxpayers and business entities taxed through the individual income tax) to write off additional depreciation in the year a qualified depreciable asset is placed in service. Since the provision accelerates the claiming of depreciation, the provision reduces taxes owed in the first year, but increases taxes owed in later years.

The same language was the most expensive provision in last year’s tax coupling bill too. Farmers are among the key beneficiaries of Section 179 expensing, which is why the lobbyist declarations on House File 2092 show every major agricultural group in favor, along with the usual business and conservative advocacy groups.

As is typical for the Iowa legislature, big tax expenditures are not scrutinized in the same way as state spending. House members approved the tax coupling bill in late January. Last year’s version had passed both chambers unanimously, and this year’s bill inspired only a little more Democratic resistance, passing by 82 votes to to 14 (roll call). Yes votes came from all 56 House Republicans present, along with Democratic State Representatives Mark Smith (the House minority leader), Ako Abdul-Samad, Bruce Bearinger, David Dawson, Ruth Ann Gaines, Dave Jacoby, Jerry Kearns, Jim Lykam, Patti Ruff, Sally Stutsman, John Forbes, Mary Gaskill, Dan Kelley, Bob Kressig, Scott Ourth, Todd Prichard, Dennis Cohoon, Chris Hall, Charlie McConkey, Phyllis Thede, Timi Brown-Powers, Nancy Dunkel, Curt Hason, Vicki Lensing, Helen Miller, and Mary Wolfe.

The fourteen Democratic lawmakers who voted against the bill were Marti Anderson, Bruce Hunter, Todd Taylor, Liz Bennett, Abby Finkenauer, Mary Mascher, Brian Meyer, Kirsten Running-Marquardt, Art Staed, Beth Wessel-Kroeschell, Lisa Heddens, Jo Oldson, Rick Olson, and Sharon Steckman. (Cindy Winckler, Chuck Isenhart, and Deborah Berry did not vote on the legislation.)

I was encouraged when the tax coupling bill stalled in the upper chamber. Senate Ways and Means Committee Chair Joe Bolkcom said in a February 18 statement,

“Based on a recommendation from Governor Terry Branstad and David Roederer, Director of the Iowa Department of Management, the Iowa Senate will not couple Iowa’s tax law with the federal changes for tax year 2015.

“We simply cannot afford to couple with federal changes this year and responsibly balance the state budget.”

I had little doubt that eventually the Senate would approve the tax harmonization, given how many powerful interest groups were pushing for it. But I hoped the bill would become important leverage in negotiations with House Republicans over school funding or Medicaid oversight.

House Speaker Linda Upmeyer and Senate Majority Leader Mike Gronstal disclosed in late February that they were talking about a deal on coupling that might involve the manufacturing sales tax break. (Without legislative action, that tax break would take effect as administrative rule.) James Q. Lynch reported at the time,

Neither Gronstal not Upmeyer were willing to divulge the substance of the private conversations about coupling. […]

If the choice is between offering tax relief to a limited number of manufacturers “or taking care of 30,000 farmers, 25,000 small businesses,” Gronstal said he would “gravitate more toward the 50,000 or 60,000 effort to help those folks (rather) than something that is much more narrow in terms of its impact.”

If the sales tax break is the price of coupling, Upmeyer is not interested.

“No. That’s a bill we sent over (to the Senate) two or three times, so I don’t think that’s something that is in the foreground for us,” she said.

Upmeyer believes many legislators — including Senate Democrats — want to “find a solution to coupling that doesn’t fly in the face of other things we’ve done.”

By early March, business people were complaining that failure to approve the tax coupling bill was making it impossible to do their taxes and threatening to cost them money.

Negotiators were making progress behind the scenes. Rod Boshart reported for the Cedar Rapids Gazette on March 9,

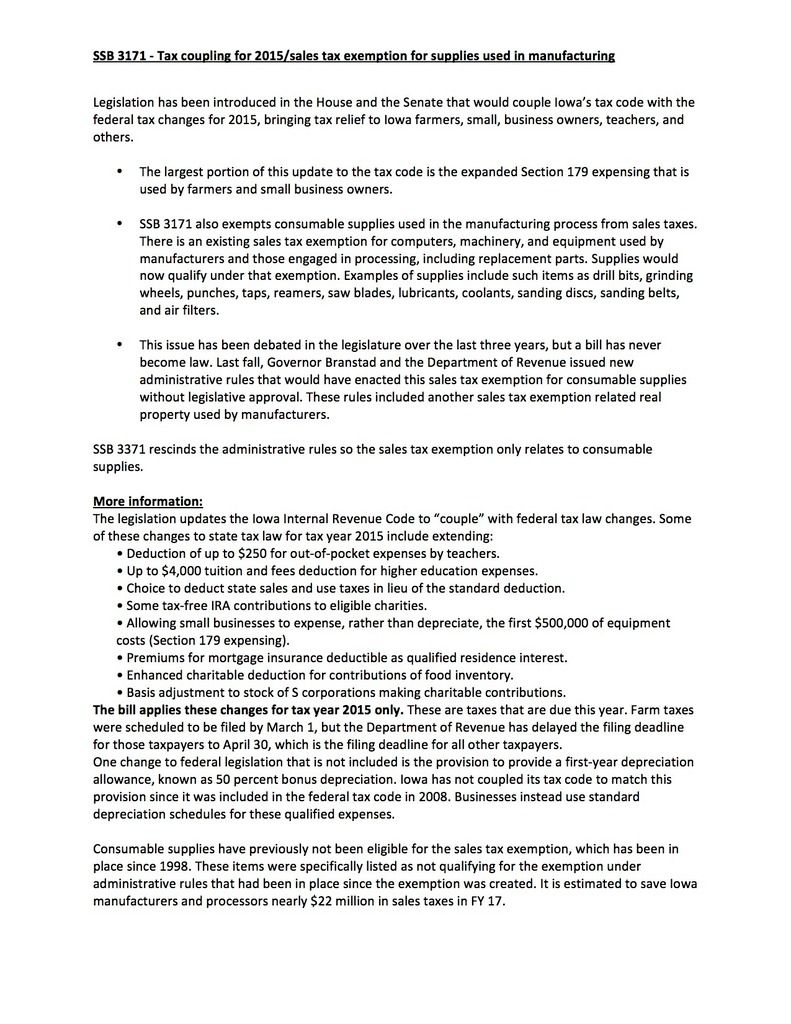

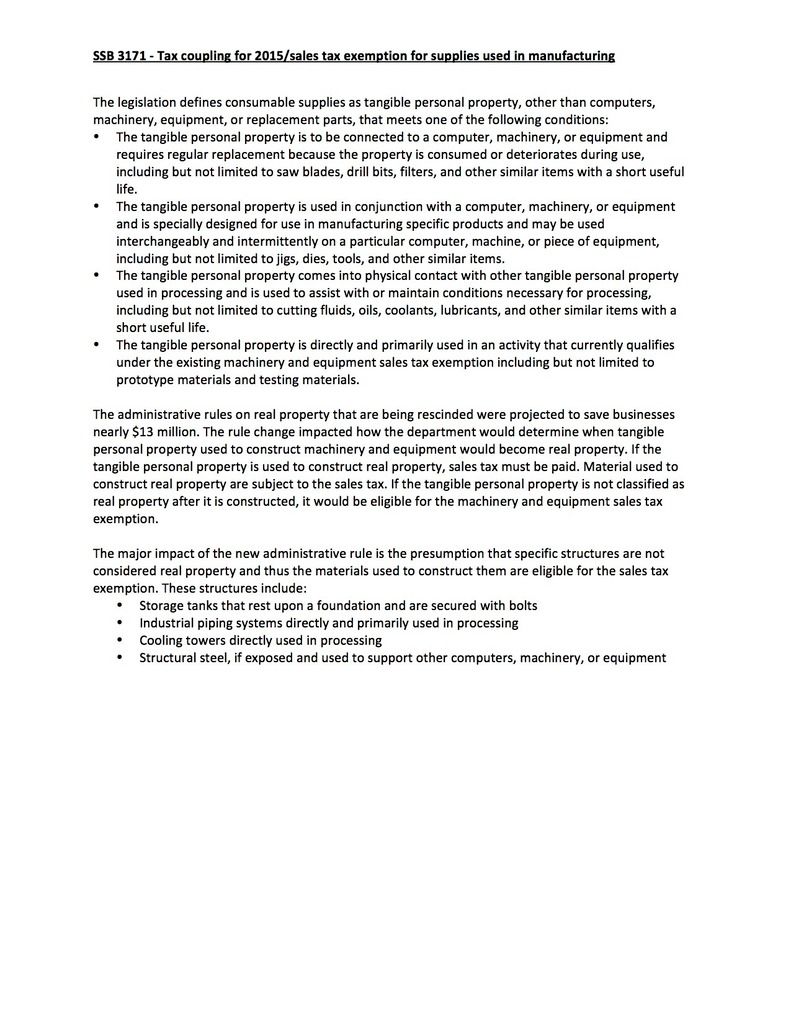

Sen. Joe Bolkcom, D-Iowa City, chairman of the Senate Ways and Means Committee, said the tax-policy compromise (Senate Study Bill 3171) called for adopting a measure passed by the Iowa House to fully couple federal income tax changes to the state tax code retroactive to the 2015 tax year and adopt a scaled-back version of state sales tax breaks on consumable supplies used in the manufacturing process.

The coupling piece would provide up to $95 million in tax relief while the manufacturing sales tax changes would total “in the neighborhood of $25 million,” Bolkcom said. Legislative action on a tax package could begin as early as Thursday, he added.

“We’re ready to move ahead with those three elements: the coupling, rescinding the governor’s rules and picking up the consumable supplies bill that the House passed in 2014. That would be in one package,” Bolkcom said.

A Senate Democratic staff analysis covered the main points of this deal and explained why exempting from sales tax the consumable supplies used in manufacturing would be less costly than the Branstad administration’s rules, which also exempted manufacturers from paying sales tax on various kinds of “real property.”

So, Senate Democrats agreed to pass a one-year tax coupling bill that will reduce revenue by nearly $100 million, and an ongoing sales tax break for manufacturers expected to cost around $21 million in fiscal year 2017, rising to $25 million annually by 2021.

In exchange, they got House Republicans to agree to scale back the sales tax break for manufacturers, saving at least $13 million per year, and perhaps much more than that. (Muller and some other knowledgeable observers suspected that the Department of Revenue lowballed the cost estimate for the administrative rules package.)

I don’t mean to downplay the value of reducing the tax break. Aside from the monetary savings, rescinding the rules blocked an unprecedented attempt by the executive branch to change the tax code without legislative approval. Allowing the power grab to stand would have been terrible, but House Republicans simply didn’t care. Agreeing to a separate large tax break was probably the only way to persuade House leaders to rescind the administrative rule. Unlike last year, Democrats did get something valuable in exchange for approving tax coupling.

Did they get enough for their concession? Like my father used to say, “Reasonable minds can differ.”

Notably, lawmakers did not wait for new data on projected state revenues before approving the tax deal. The Revenue Estimating Conference was due to meet again on March 16, but the House and Senate Ways and Means Committees passed the tax compromise legislation on March 10. After being renamed House File 2433, the bill cleared the Iowa House by 79 votes to 18 on March 15 and passed the Senate unanimously the same day.

Two Democratic representatives were ruled out of order during the Iowa House debate on this bill. Isenhart posted on Facebook,

Ruled out-of-order by the Speaker for the only time in eight years. I dared to suggest in debate that living up to the expectations of businesses who want tax breaks is apparently an important priority, but that living up to the expectations of schools, students, parents and teachers who want us to fairly fund education in a timely manner is not an important priority. I will happily bear the bruise of that smackdown as a badge of honor.

The roll call shows that all 55 House Republicans present voted for the tax compromise, joined by Democrats Bearinger, Dawson, Finkenauer, Jacoby, Kelley, Kressig, Gaskill, Cohoon, Forbes, Hall, Lykam, Brown-Powers, Dunkel, Isenhart, McConkey, Staed, Wolfe, Miller, Ruff, Ourth, Prichard, Stutsman, Smith, and Thede.

The 18 Democrats who voted against the bill were Abdul-Samad, Gaines, Anderson, Bennett, Berry, Lensing, Olson, Oldson, Kearns, Heddens, Hunter, Mascher, Meyer, Running-Marquardt, Steckman, Taylor, Wessel-Kroeschell, and Winckler. Democrat Hanson and Republicans Zach Nunn and Rob Taylor were absent for this vote.

Whether Branstad would sign the bill was not a foregone conclusion. Though he indicated support for the compromise on March 10, he preferred a larger tax break for manufacturers and, as mentioned above, had not included the tax coupling in his draft budget, suggesting it was unaffordable.

I also wondered whether Branstad might sign the tax coupling portion while vetoing the language rescinding the administrative rule on the sales tax exemptions. In 2011, he item-vetoed the primary concession to Democrats in a broad tax compromise measure. However, the governor’s item veto authority extends only to appropriations bills. The 2011 tax legislation had included some supplemental spending for education, mental health, indigent defense, public safety, and corrections. Democrats made sure that House File 2433 didn’t allocate state funds, so was not subject to an item veto. Branstad signed the bill on March 21.

Meanwhile, lawmakers were putting the finishing touches on an education funding agreement.

THE LANDSCAPE ON SCHOOL FUNDING

Statehouse leaders vowed not to repeat last year’s debacle, when lawmakers approved school funding levels six weeks after school districts had to approve their own budgets, and Branstad vetoed supplemental education funds after the fiscal year had begun. New House Speaker Upmeyer assured an audience last October, “everybody absolutely wants to deal with education quickly.” Several House Republicans echoed that sentiment near the end of the year.

This year’s legislative session began with House Republicans proposing 2 percent allowable growth for K-12 school budgets in fiscal year 2017. The governor’s draft budget set allowable growth at 2.45 percent. Senate Democrats had already approved 4 percent allowable growth for the next fiscal year.

The obvious compromise would be to set allowable growth at 3 percent. But anyone who thought that would materialize hasn’t been following Iowa legislative happenings these past five years. Predictably, House Republicans resisted going higher than 2 percent.

Numbers released after the March 16 meeting of the Revenue Estimating Conference didn’t leave a lot of leeway for extra spending. Rod Boshart reported on March 17,

Top legislators said Thursday they have agreed that the size of the fiscal 2017 state budget will be $7.351 billion, a figure that will frame the negotiations on specific spending areas.

Rep. Pat Grassley, R-New Hartford, chairman of the House Appropriations Committee, said the spending target by House Republicans, Senate Democrats and Gov. Terry Branstad represents about $176.7 million in increased spending authority over the current state budget. However, he said lawmakers also are looking at supplementing current funding by about $70 million to cover a Medicaid shortfall and other spending needs. […]

Sen. Bob Dvorsky, D-Coralville, chairman of the Senate Appropriations Committee, said talks began Thursday [March 17] on joint spending targets with much of the new money going to education and Medicaid funding. “We’re working away,” said Dvorsky, who was facing the task of shaving spending by about $58 million from the spending levels Senate Democrats initially proposed.

“Our overall target is now lower and we have to make adjustments as the law requires,” said Senate Majority Leader Mike Gronstal, D-Council Bluffs.

The new spending target was also lower than what the governor had proposed in his draft budget.

Negotiators announced the compromise on March 22. The Senate Democratic press release, “School funding compromise heads off additional uncertainty,” made no effort to spin the outcome as a victory:

Statement by Senator Tod Bowman of Maquoketa

Co-Chair of the Conference Committee on Senate Files 174 and 175“I’m glad the House and Senate have agreed to a compromise on school funding. The 2.25% agreement appears to be the best we can get, and it’s past time to let school boards know how much state aid they’ll receive for next year’s budgets.

“I appreciate everyone’s patience in regards to working through this difficult process and want to specifically thank Representative Jorgenson for his professionalism in working together to resolve this important issue.

“I hope Governor Branstad will agree and approve it in a timely manner.

“I continue to have strong concerns about the low levels of funding that we are providing in the long term for our Iowa local schools.

“Even with this increase, Iowa’s students will have fewer educational opportunities. I believe we will see more of Iowa’s rural schools being threatened with forced consolidation.

“After several tough years, we need to relook at the whole budget again. Our local schools’ success depends on our ability to provide adequate funding. That’s what the people of my district want and that’s what I will continue to advocate for at the State Capitol.”

Although many Senate Democrats seethed, most accepted the revised bill, which passed the upper chamber by 44 votes to 6 on March 23. The no votes came from Democrats Tony Bisignano and Wally Horn and Republicans Mark Chelgren, Brad Zaun, Ken Rozenboom, and Jake Chapman. Senate Education Committee Chair Herman Quirmbach said during the floor debate, “I’m going to vote for this, but I’m going to hold my nose in doing it and we need to do better in the future.” Senator Matt McCoy later told KCCI TV, “We’re disappointed, think we could have done better for our kids and our state.”

After a heated debate in the state House later on March 23, every Democrat present voted against the school funding bill. It passed by 55 votes to 41. Across the state, educators voiced their discontent. Des Moines Public Schools Superintendent Tom Ahart released an unusually pointed statement.

This compromise is not enough, and does nothing to make up for Iowa’s recent history of underfunding our children’s education. At Des Moines Public Schools the issue is further compounded by the fact that Iowa is not providing adequate funds to support the increasingly diverse nature of our district, particularly ELL and At-Risk students.

By failing to meet the needs of our schools with increased supplemental state aid, DMPS and other districts must become more reliant on property tax dollars, such as the Instructional Support Levy. For a property poor district like Des Moines, that is an unfair burden on our community. And at the same time, legislators are looking to cut into one source of funding, the one-cent sales tax, that actually helps us hold the line on property taxes.

State leaders seem determined to put Iowa’s public schools between a rock and a hard place … and then pile on more rocks. Until they start to once again provide adequate funding to our schools, and recognize the needs of our increasingly diverse students, any talk of Iowa once again being number one in education is just that: talk.

Along the same lines, KCCI-TV reported,

Waukee Superintendent David Wilkerson warns at least 100 schools with declining enrollments will see no increase and even Waukee, the fastest growing district in the state, will suffer.

“We eliminated 13 staff positions in our district. We’re sharing librarians across buildings, cut back talent and gifted programming,” said Wilkerson.

Wilkerson said the 2.25 percent increase adds up to $145 per student per year at a time when one textbook costs $100.

At this writing, the governor has not signed the education funding bill. School districts are supposed to approve their budgets for the coming fiscal year by April 15. Democrats are now in the absurd position of urging the governor to sign a bill they know to be inadequate. You can sense the frustration reading this post from the Senate Democratic website on March 29.

Compromise will allow schools to finalize budgets

The House and Senate have agreed to a compromise on school funding for the 2016-17 school year. After fighting hard for more than a year, a 2.25 percent increase in state aid appears to be the best we can get.

This compromise provides an increase of $145 per pupil over last year. After several lean years, Senate Democrats had hoped to do more. Even with this increase, schools will struggle to boost student achievement and educational opportunities.

Iowa educators warn that inadequate state support means more crowded classes, outdated books and technology, and less help for kids learning to read. This is troubling when Iowa business leaders are telling us they need more skilled workers.

We remain concerned about the long-term impact of short-changing our schools, but hope Governor Branstad will sign SF 174 in a timely manner so that our communities can prepare for the next school year.

I understand mathematical realities and the need to trim budgets when revenue projects are revised downward.

But notice how Iowans who depend on schools or other state services always seem to bear the brunt of these tough choices. No one told the business owners who lobbied for Section 179 expensing, or the manufacturers who don’t want to pay sales tax on consumable supplies, “We can’t afford to do what you want right now. There’s no room in the budget for it.”

I’m tired of watching this game play out every year, and given our collective lack of political will to assess the real costs and benefits of business tax breaks, I don’t expect things to change anytime soon.

UPDATE: Branstad signed the education funding bill on April 6.